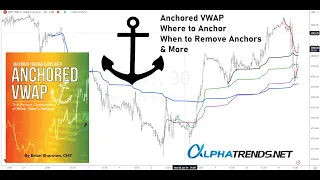

Renowned trader and author, Brian Shannon brings a wealth of experience and expertise to Alphatrends. His media engagements not only highlight his exceptional market knowledge, but also showcase his ability to effectively communicate complex trading concepts in a clear and accessible manner. Watch the following videos to learn more about market conditions and trading analysis.