Introduction

The Volume Weighted Average Price (VWAP) is the cumulative average price a stock traded for one day. The calculation of the VWAP begins when the market open, builds throughout the day, and concludes at the close of the session. For equities, users can choose whether to use pre/post market hours in the calculation. The daily VWAP resets at the start of each new day.

Because price is weighted by volume, not time, the VWAP is the true dollar average price for the period studied. Each share traded (by retail and institutional traders, long and short) receives equal weight in the calculation.

The VWAP is more responsive to volume trends than price action because of the volume weighting. Accordingly, as volume levels change throughout the day(the pace of trade), heavier volume periods have more impact on the movement of the VWAP, while lighter volume periods have less impact on the movement of the VWAP. The VWAP is a straightforward study. There are no settings, adjustments, or offsets to complicate its measurement.

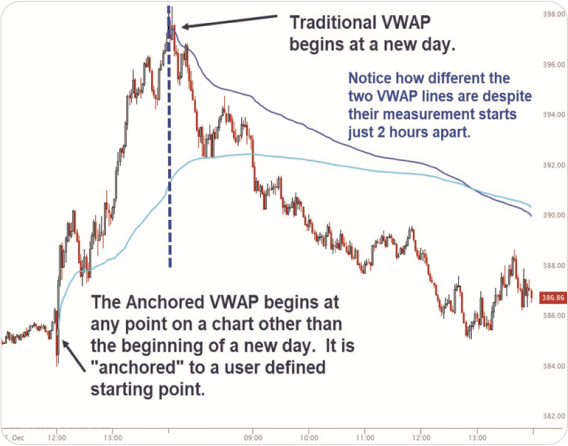

The ANCHORED VWAP (“AVWAP”) is the same as the VWAP except the start point (the anchor) for the volume weighted average price calculation is set by the user at a specific meaningful point. That is, it is not simply the start of the trading day. When we start the VWAP calculation at a point other than the start of the current day it becomes “anchored” to that first point and we call it an “AVWAP.”

The AVWAP allows us to measure from any point, on any timeframe, for any interval. The trader chooses a start point to anchor the AVWAP and once it is anchored, from that point forward the AVWAP calculates the cumulative volume and price average of each transaction. The result is elegantly displayed like a traditional moving average along with price.

The “anchor point” is the most subjective part of our analysis. The AVWAP broadcasts the message of the market more clearly than any other technical tool I have studied in my 30+ year obsession with the stock market.

My book Maximum Trading Gains with Anchored VWAP explains in detail the AVWAP, it’s components, calculation, how to choose the anchor point, AVWAP strategies, and how you can use it to increase your profitability.

There are two (A)VWAP lines on this chart, the first one (light blue) is anchored to a large price movement event. Because it starts at a point other than the beginning of a new day, it is an AVWAP. The second one (dark blue) begins with the new day, this is the traditional VWAP calculation. We can measure AVWAP on any security or market where price and volume data are available. That includes individual stocks, ETFs, futures contracts, cryptocurrencies, and Forex markets.

VWAP History

The VWAP was first introduced to the trading community in the March 1988 Journal of Finance article, “The Total Cost of Transactions on the NYSE” by Stephen Berkowitz, Dennis Logue, Eugene Noser Jr. In that paper, the authors introduced the VWAP as a quality of execution benchmark for institutions.

The authors of the paper described the VWAP as “the volume weighted average price on any day represents the price a “naive” trader can expect to obtain.” According to the authors, this benchmarkmeasurement is the difference between the reported price of the trade,by a broker to the (institutional) client and the VWAP price during the time it took to fill the order.

If a buy order is filled above the VWAP, it is considered a bad fill and it is considered a good fill if the order was executed at a price below VWAP. If a sell order is executed below the VWAP, it is considered an unfavorable fill, whereas a sell order executed above the VWAP is a job well done.

To report an order fill at a price which is worse than VWAP brings into doubt the trading ability of the filling broker and may cause the manager to reevaluate the relationship and give their lucrative commission business to another firm. VWAP is a straightforward benchmark to compare to. You either beat it and did a good job or you failed to beat VWAP and did a bad job.

Calculation

The average transaction price of an order over a specific period is easy to calculate, which is why the VWAP has become the standard execution benchmark.

The VWAP is the dollars traded for every transaction (price multiplied by the number of shares traded at each price) divided by the total shares traded during the period studied.

VWAP =

∑ (Share Price X # of Shares)

∑ Total Volume

To achieve the most accurate VWAP indicator, you want to utilize the shortest timeframe chart available without impacting the ability to see what is on the chart (too many data periods ‘scrunched up’ to see clearly on the chart.) Always use as short a timeframe as possible to get the most accurate measure of VWAP/AVWAP. As the candles become too compressed to see clearly, switch your analysis to the next longer/higher timeframe.

For intraday VWAP measurement, tick data is the absolute accurate number, but many platforms do not allow for such precise data, as it is resource intensive. For all but the most active of intraday scalpers, a 1-minute timeframe is short enough to understand the VWAP on an intraday basis.

Analysis Tool

Today, the VWAP is still used in the benchmark capacity, but it has also morphed into a technical indicator that is used by discretionary and algorithmic market participants of all timeframes.

The AVWAP shows us the genuine relationship between price and volume over any time period.It shows us which side is in control, and gaining or losing control of the trend, the buyers (bulls), or the sellers (bears)?

Our job is to “objectively listen to the message of the market” for the timeframe we wish to engage in our trades. The AVWAP provides as much certainty as we can hope for in the study of price action.

This one-minute chart shows two different (A)VWAP levels. The purple (1) is the standard VWAP from the beginning of the day, the green (2) is from the low of the day made just after 11AM. The daily VWAP is easy to determine, the second AVWAP is drawn in only after it is obvious that it was an important low. Notice how the AVWAP anchored from the low was a level that was defended by buyers (acted as support) just after 2PM and again before the close(green arrows).

The AVWAP is determined, and moves not just based on a two-dimensional component of price and time that is common to traditional moving averages. Instead, it also takes into consideration the amount of trading activity (volume) associated with that time. It is the combination of price, time, and volume that makes the AVWAP so powerful.

The way the AVWAP combines price, volume, and time into one easy to understand indicator provides a blended view of whether it is the buyers or sellers who are; in control, losing, or gaining control of price action from any point.

This information allows us to better; time our entries, cut our losers, hold our winners, or just to stand aside and let market action play out further before we decide to get involved.

- When a stock is above an advancing AVWAP, buyers are in control for that timeframe, as the average price is increasing.

- When prices are below a declining AVWAP, sellers are in control because the average price is declining.

- When prices oscillate above and below the AVWAP it indicates indecision for that timeframe.

This daily chart shows how the sellers gained control of the trend in late January after the AVWAP from the December low broken and then offered resistance in early February (1). As the year progressed, price bounces in July (2) and September (3) were overwhelmed by supply near the declining AVWAP. As the AVWAP became a battlefield in October (4), the buyers were slowly regaining control as the AVWAP flattened out. At (5) the buyers had regained control as the price surged above the flat AVWAP. Always be aware of where the price is in relation to the AVWAP and the direction of the AVWAP for evidence of who has control of the trend, the buyers, or sellers.

Anchoring Techniques: Mastering VWAPs in Futures Trading - Brian Shannon & Anthony Crudele

00:00 Anchoring VWAPs in futures trading provides a clear analysis of buyer and seller control, using time, price, and news-driven events to anticipate price movements and make informed decisions.

00:00 Anchoring VWAPs in futures trading provides a clear analysis of buyer and seller control, using time, price, and news-driven events to anticipate price movements and make informed decisions.  07:20 Consider market support, breakouts, and Fed announcements, observe VWAP levels for smart money behavior and potential profit-taking opportunities in futures trading.

07:20 Consider market support, breakouts, and Fed announcements, observe VWAP levels for smart money behavior and potential profit-taking opportunities in futures trading.  13:33 Anchoring techniques with VWAPs are used to make trading decisions based on market rallies and volume-weighted average prices, identifying important levels for buying and selling in futures trading.

13:33 Anchoring techniques with VWAPs are used to make trading decisions based on market rallies and volume-weighted average prices, identifying important levels for buying and selling in futures trading.  17:37 Anchoring techniques and the concept of the “handoff” in trading can help minimize indicators, identify significant VWAP levels, and adjust strategies based on market response.

17:37 Anchoring techniques and the concept of the “handoff” in trading can help minimize indicators, identify significant VWAP levels, and adjust strategies based on market response.  23:08 Understanding VWAP in futures trading is crucial as it indicates supply and demand dynamics, with market psychology shifting at certain moving averages, leading to less supply and more demand.

23:08 Understanding VWAP in futures trading is crucial as it indicates supply and demand dynamics, with market psychology shifting at certain moving averages, leading to less supply and more demand.  27:07 Understanding market environment and technical analysis of spy and QQQ is crucial for futures traders, as VWAPs and anchored VWAPs can identify key support and resistance levels, with consideration for overnight volume and price memory.

27:07 Understanding market environment and technical analysis of spy and QQQ is crucial for futures traders, as VWAPs and anchored VWAPs can identify key support and resistance levels, with consideration for overnight volume and price memory.  32:35 Using VWAPs as triggers for trading, analyzing market movements, and using multiple time frame analysis are crucial for consistent and low-risk trading, with a focus on uptrends, pullbacks, and support/resistance zones.

32:35 Using VWAPs as triggers for trading, analyzing market movements, and using multiple time frame analysis are crucial for consistent and low-risk trading, with a focus on uptrends, pullbacks, and support/resistance zones.  40:06 Institutions prioritize growth stocks, leading to a simple supply and demand dynamic in trading, and using anchored VWAP can confirm any trading strategy.

40:06 Institutions prioritize growth stocks, leading to a simple supply and demand dynamic in trading, and using anchored VWAP can confirm any trading strategy.