Episode Info

00:00 Brian Shannon is introduced by Shawn Catena

00:00 Brian Shannon is introduced by Shawn Catena 01:22 Missed opportunity to buy NVDA on gap up, bought on pullback, scaled out and raised stops for $152.30 gain, also holding CPRT and CRSP.

01:22 Missed opportunity to buy NVDA on gap up, bought on pullback, scaled out and raised stops for $152.30 gain, also holding CPRT and CRSP. 03:17 Traders are staying late for the market recap show, with a focus on potential breakouts and levels of interest in various stocks.

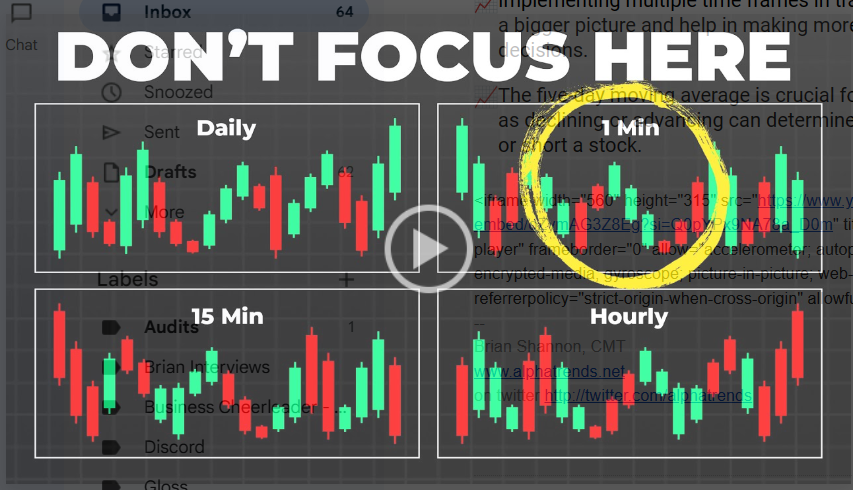

03:17 Traders are staying late for the market recap show, with a focus on potential breakouts and levels of interest in various stocks. 04:40 The speaker discusses the development of the Anchored VWAP by Dr. Paul Levine and how it was accidentally discovered on a platform called RealTick, and how they convinced TC2000 to include the anchored VWAP on their software.

04:40 The speaker discusses the development of the Anchored VWAP by Dr. Paul Levine and how it was accidentally discovered on a platform called RealTick, and how they convinced TC2000 to include the anchored VWAP on their software. 06:33 Brian Shannon discusses successful trade, market at a level of interest, preference for shorting SP, potential double top in semi market, focus on intermediate term trends.

06:33 Brian Shannon discusses successful trade, market at a level of interest, preference for shorting SP, potential double top in semi market, focus on intermediate term trends. 09:12 Tesla performing poorly, potential removal from mag seven, concerns about buying dips, criticism of Cathie Wood; speaker criticizes track record and management fees, suggests better risk management and indicators for improved results.

09:12 Tesla performing poorly, potential removal from mag seven, concerns about buying dips, criticism of Cathie Wood; speaker criticizes track record and management fees, suggests better risk management and indicators for improved results. 11:23 Tesla is at a declining 5-day moving average with potential for a long trade, but money is flowing out of the stock, so consider investing in IBIT (Bitcoin) instead for potential growth.

11:23 Tesla is at a declining 5-day moving average with potential for a long trade, but money is flowing out of the stock, so consider investing in IBIT (Bitcoin) instead for potential growth. 14:02 Brian Shannon is highly appreciated and respected in the trading community.

14:02 Brian Shannon is highly appreciated and respected in the trading community.