Episode Info

-

Understanding supply and demand, as well as the footprints left by institutions, is crucial for building a successful trading strategy.

Understanding supply and demand, as well as the footprints left by institutions, is crucial for building a successful trading strategy. -

Understanding when to be bold and when to back off in trading is key, but always remember that risk management is the cornerstone of success.

Understanding when to be bold and when to back off in trading is key, but always remember that risk management is the cornerstone of success. -

Understanding who’s in control of the instrument is crucial for making trading decisions, especially in protracted down trends or when entering short positions.

Understanding who’s in control of the instrument is crucial for making trading decisions, especially in protracted down trends or when entering short positions. -

If you can’t define your trading edge, you really don’t have any reason to put risk on.

If you can’t define your trading edge, you really don’t have any reason to put risk on. -

The use of technology helps instill a sense of patience in trading, preventing overtrading and FOMO, leading to better tradeoffs.

The use of technology helps instill a sense of patience in trading, preventing overtrading and FOMO, leading to better tradeoffs. -

Setting guidelines for buying and selling based on emerging strength and potential resistance can lead to greater gains and smaller losses in trading.

Setting guidelines for buying and selling based on emerging strength and potential resistance can lead to greater gains and smaller losses in trading. -

Position sizing is probably the most important thing that I bring to the table in terms of defining an edge.

Position sizing is probably the most important thing that I bring to the table in terms of defining an edge. -

Re-entering the market strategically is crucial for capturing big moves and making a successful year in trading.

Re-entering the market strategically is crucial for capturing big moves and making a successful year in trading.Anchoring and Supply/Demand Dynamic

-

Anchoring to the point of a catalyst like an earnings report can help identify supply and demand dynamics in trading.

Anchoring to the point of a catalyst like an earnings report can help identify supply and demand dynamics in trading. -

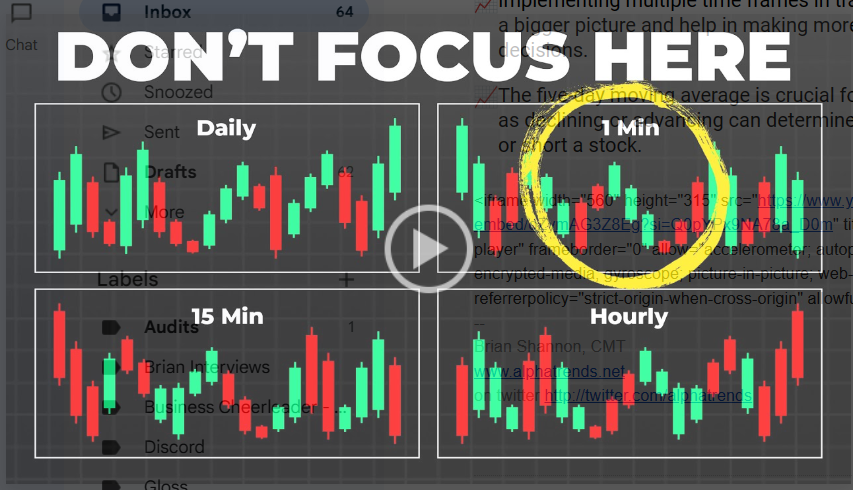

The importance of defining anchor points for trading decisions based on recent and relevant price action.

The importance of defining anchor points for trading decisions based on recent and relevant price action. -

Anchoring from the high to the gap can indicate a potential squeeze, leading to strategic trading decisions.

Anchoring from the high to the gap can indicate a potential squeeze, leading to strategic trading decisions. -

The anchor from the peak can provide accuracy in predicting price movements.

The anchor from the peak can provide accuracy in predicting price movements.