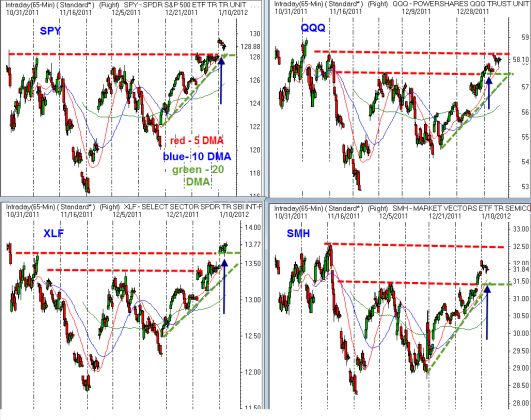

Markets are quiet today, but the $XLF continues to march higher towards the 200 day moving average at 13.99 and the October high of 14.17. We still have a constructive pattern of higher highs and higher lows with near term important levels to hold of $SPY ~128.20 $QQQ ~57.70 $XLF ~13.55 snd $SMH ~31.50.

The rally from the December 20 lows has now brought markets 7-8% higher without any meaningful pullback, and with a lot of the little “junk stocks” experiencing huge runs it is time to be extra cautious. The little names typically begin their runs when higher quality names have been picked over and people throw caution to the wind. It is not unusual for a pullback to begin in broader markets once this “frothy activity” occurs. Keep in mind there are no concrete signs of an imminent pullback, this is just an observation about the nature of risk management.

BTW, keep an eye on RENN mentioned on Monday in SFO article.