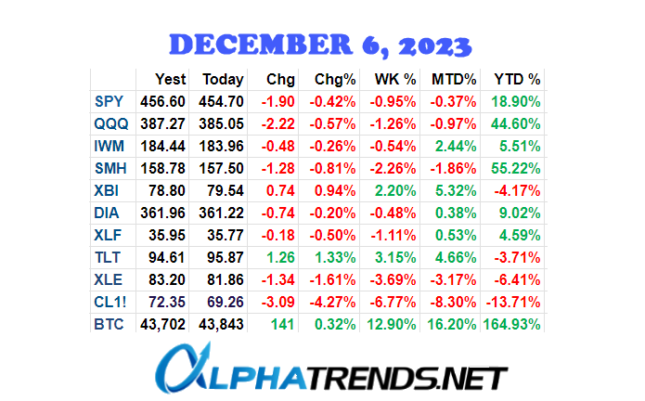

The market lost ground today, breaking a trend line and closing below it, signaling a slowdown in the rate of ascent.

We've had this huge run and really haven't had any time to see a real pullback in prices.

"I like an alignment of Trends. So when I see the primary trend is higher, I want to be long and I don't want to really take advantage of the short side

The NASDAQ has been weaker compared to the S&P 500.

Opportunities exist in the bigger trend, but it's best to prefer when the trends are aligned.

Biotechs have a pattern of higher highs and higher lows above a rising 5-day moving average, suggesting a bullish trend in the intermediate term.

Oil crude oil is getting annihilated here which is great for anyone who puts gas in their car or many other things in the economy.