Episode Info

This 95 minute talk covers a wide range of topics, here is a timestamp for what was discussed.

Timestamps

0:00 Introductions

1:11 First getting interested in the Markets

1:40 Making 5000 Dollars on his First Trade

2:45 Working as a Broker

4:35 Trading at a Prop Firm

5:15 Starting a Day-Trading Company

6:35 Swing Trade Timeframe

7:42 Early Mistakes Brian Made

8:20 Don’t argue with the Market

10:00 Only Price Pays

12:20 Books and Resources

15:35 Mental Side of Trading

16:15 When you commit your money you commit your emotions

16:45 Tools and Resources

20:11 Trading Statistics

23:15 Selling into strength

24:30 Weekend Routine

26:29 Noticing themes in the charts

30:00 Building a weekly Universe List

31:00 Daily Routine

34:20 How many trades during the day does Brian make?

36:40 Preparing for the next day

37:50 Hobbies outside of Trading

38:29 VWAP Volume Weighted Average Price

41:40 How Institutions use the VWAP

44:20 Using the VWAP to judge supply and demand. Who is in control?

47:00 Don’t buy the dip when the sellers are in control

49:50 Where to anchor the VWAP

51:40 The VWAP as a benchmark

54:30 Character Change Points

55:25 Moving Averages

58:20 the 5 Day moving average

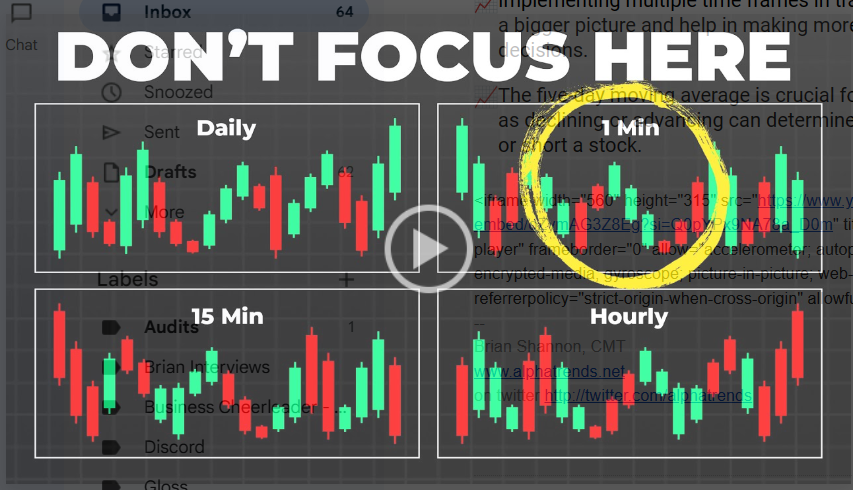

1:01:30 Trading using Multiple Timeframes, Trend Alignment

1:06:50 Always ask where has it come from?

1:08:00 VWAP Handoffs

1:11:40 LCID Trade

1:13:15 Chase the Gap or wait for VWAP

1:17:25 Daily R2

1:19:25 Position Sizing

1:26:30 BROS Analysis

1:30:30 VWAP Pinch

1:33:00 Don’t Buy the dip blindly

1:35:10 Advice for new traders