There is no such thing as “down too much” when there are still sellers in the market. The current market condition is why I say over and over “don’t trust rally attempts for more than a daytrade when the 5-day moving average is declining.”

On Tuesday the market experienced a beautiful and tradeable intraday bounce, but with a declining 5DMA, we knew it was not something to be trusted and that is a good thing! As I mentioned in a less than eloquent way in the Tuesday night video, “if you try to pick bottoms, you will only get stinky fingers.” Well if you aren’t sure what that smell is, it is fear and losses!

Today I was on a mini vacation and, so I did not trade 1 share of stock and I am glad, as it looked like it was dangerous. With my risk management principles, I am sure I would not have tried to short “in the hole.” I would rather miss a trade than lose money trying to go against the momentum.

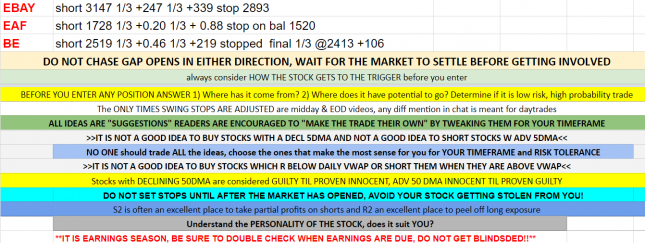

Below is an update of our stocks

From our watchlist, the BYD short which we initiated at 3148, we took 1/3 + 0.58, 1/3 + 2.23 and the stop on the balance should be at 2895.