Why do you have a picture of the Unabomber on your support & resistance slide?

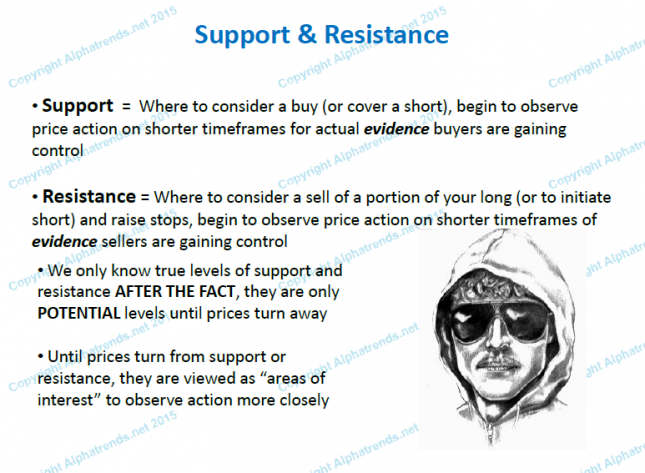

As I often mention, we only know true support or resistance after the fact. Until a stock drops to a level and begins to turn higher, it is only a potential support level.

Another way to look at a potential support level is as an “area of interest” similar to how police have a “person of interest” before they charge someone with a crime. From what I see in the news and on television, in a police investigation, they keep tabs on their person of interest until they are confident enough that they have evidence for a charge to go to court and be presented. They don’t want to press charges in a flimsy case that has low odds of bringing a guilty verdict.

Just the same, in a market transaction, you want to make a stock purchase only once you have actual evidence of buyers stepping in and regaining control, you don’t want to buy blindly at a level on the chart. Understand the psychology of why support and resistance develop and you will have a great advantage over most participants. (READ MORE BELOW THE PICTURE)

Support and resistance levels are where we really get to see the battle between the buyers and sellers and get to see how prices actually move. The continual battle between the bulls and bears is what makes the stock market a fascinating study of the basic laws of supply and demand. A technician studies how a stock reacts to these battles so that when a trend re-exerts its strength in either direction, we are sure to be on the right side and able to participate in the moves that follow.

Have you ever bought a stock, watch it decline in price and wish you could just get out at a breakeven? This type of buyers’ remorse shows up on a chart as resistance. Obviously, one persons stock won’t offer much resistance, but when it is at a important level for the stock, it becomes much harder for the stock to work through the supply being offered before it can move higher.

The same emotions come into play when a stock is forming support on a chart. Have you ever sold a stock after it has done nothing for months and then see it almost immediately turn higher without you, as if “they” know you are out and agree it take the stock higher without you? Of course this doesn’t really happen, but you probably wish you could buy it back at your original cost. These actions, repeated by many buyers and sellers form support for a stocks price.

Learn more about technical analysis and the practical application to trading in the ALPHATRENDS TRADING COURSE