I wanted to address a problem that many traders face, which is the fear of missing out on a profitable trade opportunity. Every one has done it, and many losing trades stem from this exact problem. There is no reason to rush into a trade after it has already missed an ideal entry point because there are new opportunities that arise every single day in the market.

A few examples of how FoMO can affect your trading success.

- A stock on your watch list started to soar and you didn’t want to miss out on the potential further upside, so you rush into a market order to buy the stock, only to see the stock fall.

- A stock is receiving a huge amount of social media attention and you’re not involved in it. However, you believe it isn’t too late and you want to partake in your piece of the profit, so you enter at a bad entry point, only to see the stock develop into a loser.

- A stock that hasn’t yet reached an ideal entry point looks ready to explode, so you enter in the stock, afraid to miss out, only to see the stock fail.

These are just few of many examples of FoMO in action. It stems from the low levels of psychological needs satisfaction. We all want to be involved in winning stocks and all want to make consistent profits.

A great trader knows the importance of consistency, rather than attempting home runs, which can lead to gambling tendencies.

There are numerous ways you can eliminate FoMO from your trading.

- Realize there are new opportunities that arise every day. Just because many people are involved with a winning stock, doesn’t mean you have to jump into it to participate. This will lead to bad entry points and gambling, which will ultimately deteriorate your win-rate.

- Stick to a methodology and never drift from it. Every trader has his/her own style of trading. If it works, don’t fix it! Block out all the noise of news, social media, etc. and stick to your methodology. Many trading algorithms succeed because they are programmed to trade a certain way and never drift from the plan. As traders, we have to eliminate emotions from our trading plan altogether!

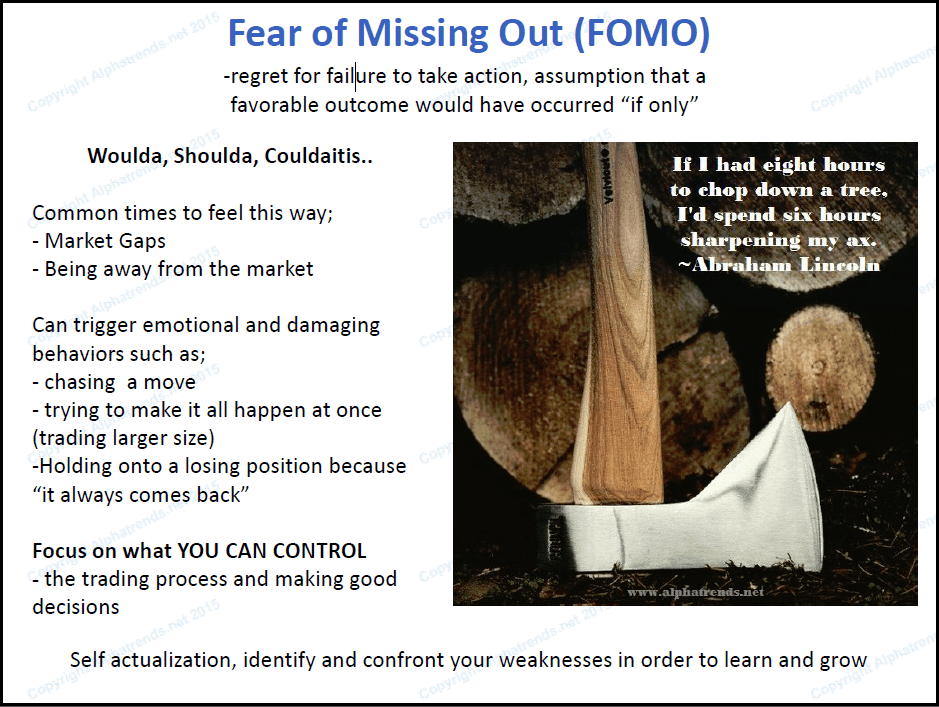

Above this post is a slide from the Alphatrends Trading Academy – Introductory Course. For more information about the course, and to learn how to trade stocks correctly, click here.