Markets are higher once again as the intermediate term pattern of higher highs and higher lows remain intact. If we are to break key support levels then it would be time to become defensive, but not bearish as the daily charts are also constructive. Although I believe that low risk entries and strong risk management are more important than price targets I have included a few below.

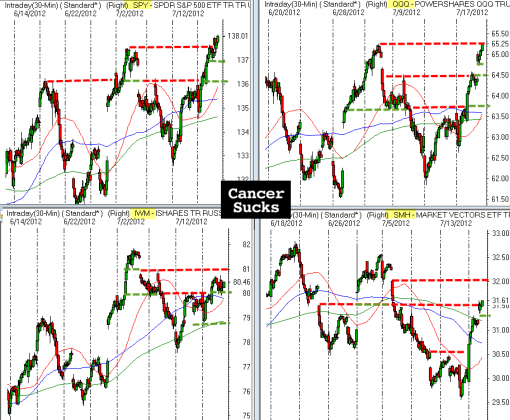

$SPY – the near term support we want to hold is now found ~137.00 Potential upside for this run is approx 139.50

$QQQ has exceeded the highs (6525) from 2 weeks ago and today’s low of 6472 will be the near term level we would like to see hold as support. The next upside level which looks likely is ~66.00

$IWM the Russell is struggling to keep up with the SPY and QQQ and it would be good to see this market put some distance between the prior resistance of 79.80-80. Failure to hold above 79.80 for more than an hour or so would be a good reason to become much more defensive.

$SMH the semis continue to squeeze some shorts who overstayed their welcome, but this rally is likely to fail soon as it is now just above the declining 50 day MA. It seems likely that this market should pullback towards 3050-3075 at some point over the next few sessions but shorting it into this momentum is foolish.

It could be argued that markets are “overbought” but until the pattern of higher highs and higher lows is interrupted it should be considered “Innocent Until Proven Guilty” Strong defense wins the game!

I am just $240 away from raising $1,000 by this tomorrow for cancer research. If you are a free visitor to this site would you help out? DETAILS HERE