Last Friday the market closed on the low of a week long selloff and the market looked terrible. On Monday, the markets exploded higher with a large gap, which left shorts scrambling to cover and sidelined cash wondering if it was just a blip in a downtrend. As the market held the gains we saw another large gap higher on Wednesday which further pressured shorts and make disciplined traders who are accustomed to “cleaner setups” feeling like they once again missed out. Of course there were intraday opportunities and some decent setups, but most of the people I know felt like they missed a lot of the action.

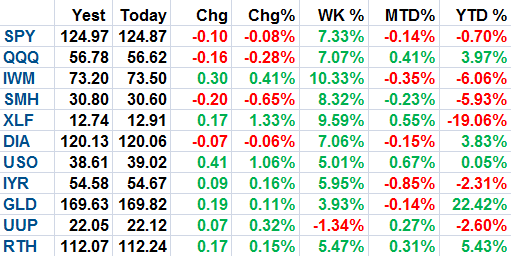

To keep things in perspective, the $SPY is still negative YTD, despite a massive 7.3% rally this week. The market volatility has been phenomenal this year and there is no reason to think things have settled down or become more normal. The video below discusses some of the key levels to keep an eye on from here.