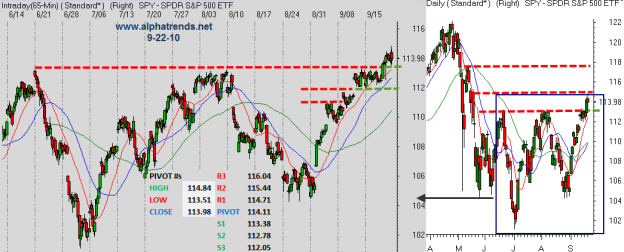

The SPY is in an uptrend. It is continues to make a pattern of higher highs and higher lows above a rising 5 day moving average and until that pattern is broken buyers should continue to be given the benefit of the doubt. It doesn’t mean there shouldn’t be any doubt at all though, the market has run far and fast over the last three weeks and that makes it susceptible to profit taking. Looking objectively at price action, we saw a break past significant resistance at 113.20 this week and while prices remain above that level a larger pullback is just a dream of hopeful bears. Hope doesn’t pay the bills, only price action does.

The volatility after the Fed announcement on Tuesday does give us reason to be more defensive, but the attention should be given to stocks where stops can be kept tight within primary uptrends, not on trying to pick a top in a momentum name. Until the market shows sustained weakness below a declining 5 dma, short sales should be kept to; daytrades while below a declining VWAP, short some weaker names and small hedges if you are nervous about giving back large unrealized profits.