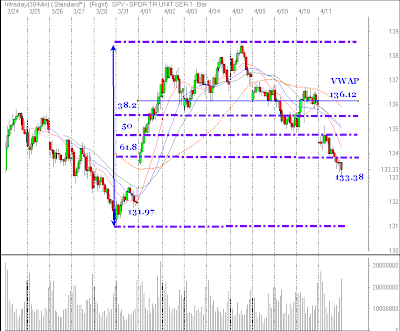

On March 31, the SPY closed at 131.97.

On Friday, the SPY closed at 133.38.

For the month, the SPY is up 1.41.

Those are the facts.

But is the average participant up for the month? If they bought at any time during April and are still holding the answer is no (except for a handful of people who bought late Friday). The average price the SPY has traded at this month is at 136.12, this number represents the Volume Weighted Average Price (VWAP) since the beginning of the month. The April 1 move got a lot of attention but now those gains are rapidly deteriorating.

The rally from low near 131 to the high near 138.60 has now retraced more than 61.8% which is technically considered to be a failed move.

Price has memory and the more recent the price activity (in particular if there was a strong emotional event like we saw) the fresher the memory and the stronger the emotional responses. Time heals all wounds right? Well the recent financial wounds are still in need of much more time to heal and the risks in this market remain large as it struggles to find a bottom. Earnings reports this week from some large and important company’s (GOOG, MER, ISRG, SPWR, EBAY, WM, C, IBM, JPM, etc) will make it extra treacherous.