This is a question from a reader, I usually do not post these but thought it might be helpful to other readers.

Brian,

for instance with daytrading in mind:

– resistance is at 135

– sold short at 135

where to put stop on short SPY in this case, because it often happens, as it did yesterday, I get stopped out at 135,62 … so give it a full point? or point and a half?

thanks, Dirk

Dirk,

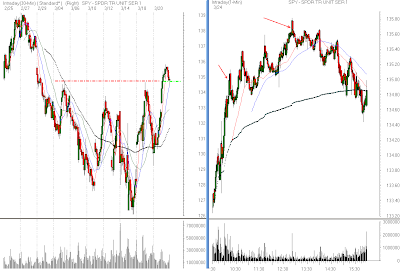

Resistance is only know after the fact. You were looking for POTENTIAL resistance near 135, but it never materialized as the market blew right through that level with ease. A prior level of resistance (like 134.50-135 on SPY) is a place to watch the action closely for clues that the sellers are defending that level. When you identify such an inflection point, you then want to switch the analysis to a shorter time frame for confirmation of a low risk/high profit potential trade. Looking at the 1 minute chart you can see the arrows I put in to show your entry and exit. At the time of entry the market was in a solid uptrend with a quickly advancing daily VWAP, you were fighting the trend and odds were against you. The market continued to make a series of higher highs and higher lows right up until after you exited (I know how much that hurts). Forget resistance, VWAP, moving averages and everything else for a moment and look a the the 1 minute chart price action only. UPTREND- higher highs and higher lows. If the market is in an uptrend on the time frame you are trading, why sell short? Wait for price confirmation and then use the definition of a downtrend (lower highs and lower lows) for your stops. Once you have entered a short sale, you want to trail your stops lower just above the most relevant lower high (violation of the lower high nullifies the downtrend)(corrected 5pm Eastern sorry for the confusion). There is usually no reason to risk more than $0.40 – .50 on a daytrade in SPY.