I am a trader. I trade individual stocks based in the United States and exchange traded funds of US equity indexes. I have traded US equities since 1991, it is my area of interest and expertise. That is what works for me. I have never told anyone else what they should be interested in or what they should trade, it is simply none of my business.

In my weekly videos I used to cover the price of Gold, however I felt I was not providing value, as it was not an area of interest for me personally and I felt like I was going through the motions to satisfy others. At the end of 2014 I discontinued talking about Gold and at that time I stated the reasons why. Here again are those reasons.

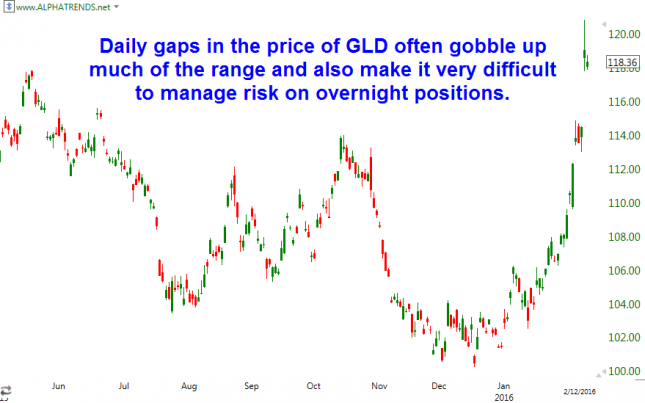

1- Erratic daily price action. Look at the chart below of Gold, almost every single day Gold gaps higher or lower in the United States, based upon overnight global trading. I value my sleep and don’t want to stay up all night watching (or worrying about) the price action overseas. A lot of the daily range in Gold is gobbled up in its daily gaps which makes for messy charts. Perhaps more importantly, it is very difficult to control risk on the timeframes I like to trade (swing trading) when you are almost assured of a gap the next morning.

2- I am a trader, not an economist. I find it much easier to trade the action of US equities than to try to figure out the intricacies of global politics, currencies, interest rates and their complicated inter-relationships, which play a factor in Gold pricing. Never mind the “other reasons” for Gold movement like the “Indian wedding season.”

3- I don’t use Gold for anything. I like the US dollar. I can accumulate them, invest them and spend them on experiences and things that satisfy me personally. I have yet to come across a place where you can exchange Gold coins for the things which enrich my life personally. You can knock the US dollar all you want, but despite all the flaws you can mention, it is still the “prettiest girl at the dance.” To me Gold is as useful as diamonds or Bitcoins (which are actually easier to exchange for goods than Gold.)

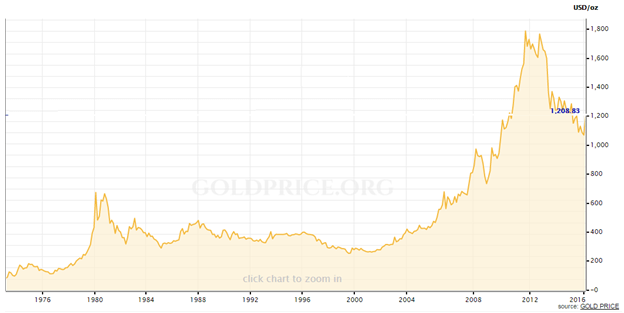

4- Ignore the Gold bugs. I generally view the “Gold bugs” as pessimists who have an unhealthy relationship with a commodity. It is not dissimilar to Apple” fan boys” who believe that the share price of Apple Inc will always go higher. ALL assets experience the cyclical flow of funds in and out of them, there is not a single one which is immune.

I know some people will use this chart as “proof” that Gold is a good investment, and maybe it is. But I am unwilling to wait 25 years to breakeven like buyers in the early 80s did. If that is YOUR timeframe then cool, buy and hold. That is not a timeframe where my analysis adds value.

5- Just another trading vehicle. If you like to trade Gold, then that is what YOU should trade. I hope you do well with it, but I have as much interest in it as I do the price of natural gas, cotton, diamonds or women’s shoes.

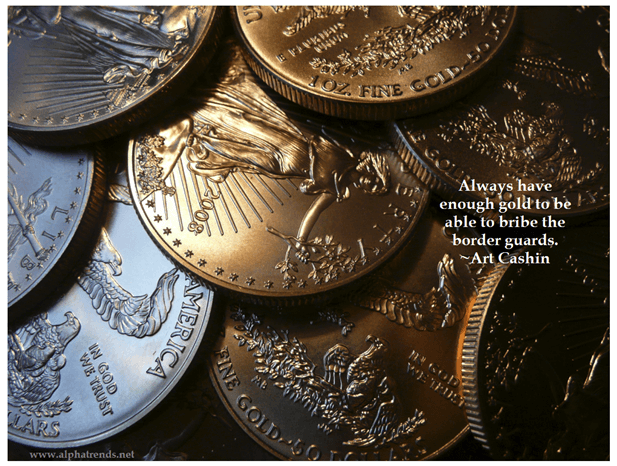

6- Best advice on Gold? From Art Cashin, “Always have enough to bribe the border guards.” I do own a little bit of bullion, but it is insignificant if it goes higher. I will be pleased, but it certainly won’t make me “rich.” If the Gold bugs are correct, then I hope I will be able to move to safety beyond any unforeseen border.

Quote by Art Cashin, picture taken of Gold by me.

7- Best advice on trading? Know YOUR timeframe and do what works for YOU! Why worry about what others like or dislike?

8- What I would like to do with my Gold.

Creepy selfie 🙂

If you disagree with my Gold that is fine. I am not looking for arguments, only to provide value where I can. That is what I do each day at Alphatrends.