0147: Review of some of the stocks Brian had looked at over the past few days and how we avoided entering into bad trades.

CELH, CMS-0218, GFS-0311,

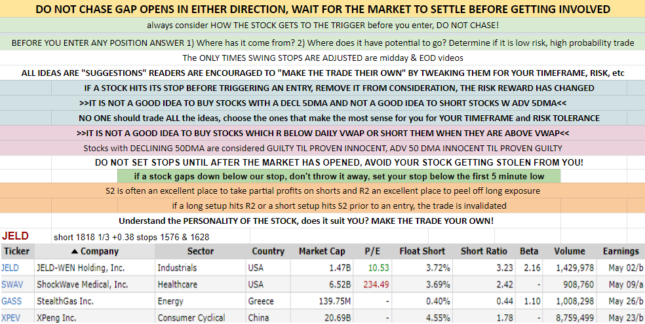

0511 C-list ideas for 6/14/2022

0511: Where do I anchor the VWAP from?

1036: Review of the BIG leader stocks (on the side of his trading screen). AAPL, AMZN, COIN, META, MSFT, NFLX, NVDA, TSLA, TWTR, PTON, ROKU,

DON"T BUY STOCKS IN DOWNTRENDS!!!-Below the 5DMA

Protect your gains

Don't buy the rumor.....

2056: QUESTIONS FROM THE EMAILS

2112: How to manage a trade better generally. Midday video usually gives you an idea as to where the stocks have made their daily low, and then where we can manage the stops. This market is tough, need to be on top of all the trades.

2247: RIG- Managing the trade. Goal is NOT TO BE a day trader. In this market, you may have to day trade to make some trades. This is a tough market. That is why most ideas are B or C list ideas.

2601: Options Strategies- Are problematic in themselves. eg expiration date, how much to buy, in/out the money etc. Too many variables for most traders.

2720: Which platform to use? Brian uses TC2000.

3045: How to deal with FOMO? Lot's of losses from doing stupid things. Checklists- where has stock come from, where does it have the potential to go to, what is the risk/reward, direction of the 5 DMA, don't listen to the news, etc.

3357: Taking C-list ideas off the spreadsheet. Still looking at them to see if there is something developing,

3507: What does being emotional in trading mean? What is my motivation to the trade.

3740: GOLD about to "explode". Where are we in reference to the MA's? Think of it as a trade!!!

3942: Trading ETF's. Also needs the ADV of 500,000 share/day to trade it.

4009: Do you expect the stock to return to the VWAP? No...What about when the 5DMA and the VWAP cross? Does this change the trend?

4126: Send webinar questions to 1bshannon@gmail.com, not to the support email address.

Divergences when the 50 MA's are in an uptrend on the longer TF and in a downtrend on the lower TF. Maybe looking at a 50 period MA. Simple MA's are PERIODS not time intervals.

So a 50MA on the 15 minute chart is fifty of the last 15 minute candles. Not the past 50 days. (only on a daily chart would it represent the past 50 days.)

4359: Trading Breakouts (BO's). Generally Brian likes to sell into BO's, not buy them. Also, don't buy the pullback.

4550: Great explanation of what Brian means in don't buy pullbacks. BUY STRENGTH AFTER THE PULLBACK

4634: You are going to miss some trades when they GAP lower at the open.

4925: When to place the stop loss?

LIVE QUESTIONS

5040: Using The index to enter a trade. eg. If like a stock long, but the market is in a downtrend, it will be a B-list idea instead of a A-list idea. Position Sizing.

5226: Follow up on the BO question. Buying the BO on the 15Min chart.

EMAIL QUESTIONS

5320: NEW stock evaluation.

5429: Link to get the discount on TC200.