One of our strategies is to peel off one-third of our position at daily R2 on the day first day of entry.

The reason for selling 1/3 into initial strength is to lock in a profit on a small portion of the trade.

Daily R2 is used because it is quite often the high of the day for a first-day mover, this is a result of sell programs based around pivot levels.

We sell a small piece of our position to lock in some gains, thereby reducing the risk on the balance of the position. This puts us in a position of strength and minimizes the damage if the stock reverses lower.

As always, this technique is merely a suggestion on how to reduce risk in a position. If it doesn’t make sense to you, then DO WHAT IS RIGHT FOR YOU!

When a stock moves very rapidly up to daily R2, it will often continue higher and that is when we want to use the “2 Minute Exit.”

The idea is to try to maximize our gain in a quick-moving stock by watching it closely and raising our stop up under the low of a 2-minute bar.

Below are some examples of how to use this strategy.

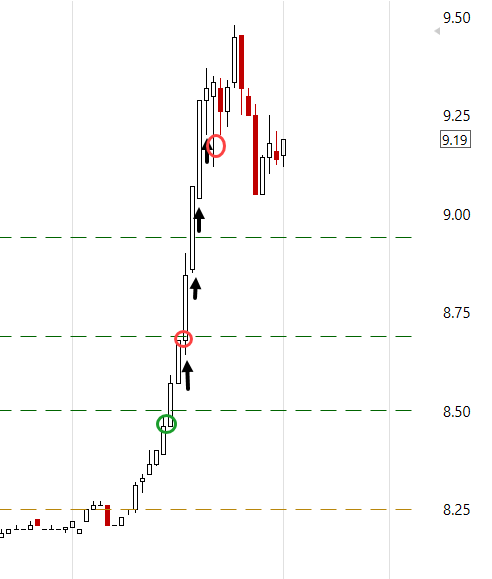

This stock was purchased at 8.47 and it quickly ran to daily R2 at approximately 8.68, if you had sold 1/3 there it would have resulted in a quick 19 cents.

If instead, you waited for the stock to make a new 2 minute low, you would have sold the stock approximately 10 minutes and 0.48 higher!

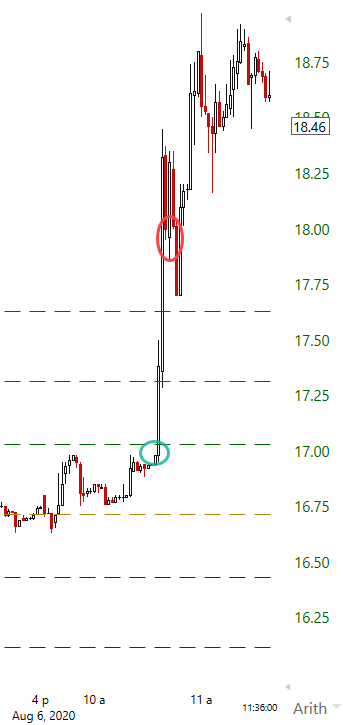

Here is an example of a stock that was purchased the prior day at 16.48. You can see, on the first 2-minute candle, the stock opened quite strong and if you had sold 1/3 at R2 ~17.24 you would have locked in a gain of 0.76, a nice gain for a $16 stock.

If instead, you had waited for a new 2 minute low, you would have sold at 1815, $0.91 higher in just 16 minutes. This would have given you a gain of $1.67, or over 10% on the first third!

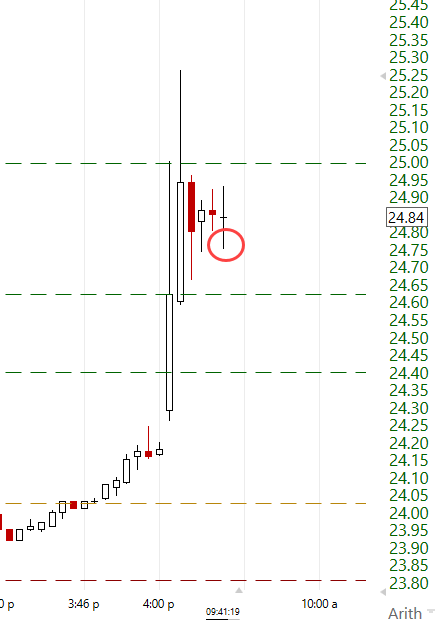

Here is another stock that, if sold on the opening drive to R2 would have resulted in selling at 24.62, waiting for a new 2 minute low would have resulted in selling at 24.78, an additional gain of $0.16/ share.

You won’t always make a much bigger gain, but what if you could get an additional half to 1% on some of your winners, do you think that would add up to significant improvement at year-end? I do!

Here is a stock which was purchased at 17.00, it quickly ran to daily R2 at 17.28, but waiting for a new 2 minute low ould have resulted in holding the stock for an additional 8 minutes which would have resulted in selling at 1795, more than 3X the profit if you had hastily sold at daily R2!

The arrows on this stock show how after each candle closes, the stop is raised up under the prior 2-minute candle low.

REFERENCES

Pivot explaination

If your trading software doesnt have pivot levels on it, you should think about a different software. If not, HERE IS A PIVOT CALCULATOR

4 Replies to “2 Minute Exit”

Leave a Reply

You must be logged in to post a comment.

Thank you for all of the charts. This was very helpful! Maybe we will have a stock to give it a try on today.

This suggestion is great and much appreciated.

Thank you very much – this really helps.

Thank you for this post on the “2 Minute Exit”. This clears up why you might choose to use the 2-minute timeframe to raise stops as the price is rapidly going up to Daily R2. The link to the Pivot Calculator and other useful tools/information was quite good too.