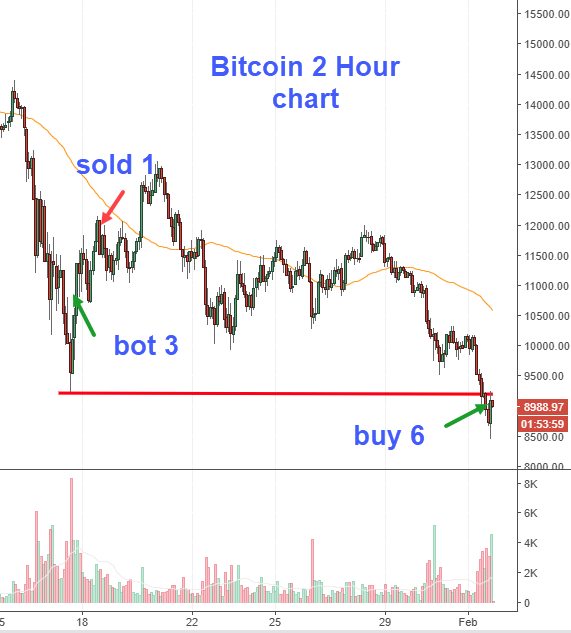

Bitcoin undercut the prior panicky selloff low which occurred on January 17. The selloff today brought BTC down to the 61.8% retracement of the low in July of 2017, so far it is bouncing from that level. You can also see how that level is also the 150 day moving avearge (green.)

Our most recent purchase of bitcoin was for 3 risk units at 10,750 and we sold one with a 10% gain, as outlined in the Alphatrends Crypto Trading Plan of Action Remember, this approach assumes there is big risk and we are NOT trend trading with this portion of the crypto allocation of your account.

Here is how we are going to add 6 risk units (again, see the trading plan linked above).

We will purchase 6 risk units at a price of 9000 or better, we will then be holding 8 risk units at an average price of 9,437.50 (10,750 x 2 =21500) plus (9000 x 6 = 54,000)

21,500 + 54,000 = 75,500

75,500/ 8 = 9437.50 avg price.

We will sell 3 risk units at 10,381 (10% higher than our average purchase)

***8PM EASTERN UPDATE***

We will now initiate our final “bounce trade” allocation at a price of 8,050. We will purchase 10 risk units at 8050 which is just above the 61.8% retracement of the 2017 range and the 200 DMA (both shown on chart below.)

If we get filled, we will own 18 units as follows.

2 x 10,750 = 21,500

6 x 9,000 = 54,000

10 x 8050 = 80,500

21,500 + 54,000 + 80,500 = 156,000

156,000 / 18 = 8,667 average cost

If we are filled on this purchase we will sell 6 units at 9,535