In Monday nights webinar (SEE RECORDING HERE) we spent a good amount of time talking about why we DO NOT set our stops until AFTER the market has opened and settled down for a few minutes.

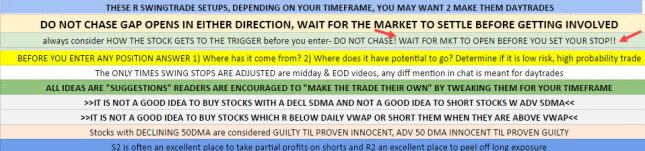

On Tuesday, morning two of our overnight stocks opened below our suggested stop levels but we did not execute the trades. Explanation to come, but first, read the notes on the image below.

This image is on our trade sheet every single day. I put it there because there are some very important concepts which I consider to be basics of trading.

The one you see with the red arrows “wait for market to open before you set your stop!!” is in caps and has 2 exclamation points after it, it is the only one with two exclamation points.

When I wrote this sheet, I tried to use strong language so subscribers would realize the importance of this concept.

Please familiarize yourself with all the information on this sheet, print it out, make it part of your everyday thought process.

Let’s get to the two stocks which hit the “official” stops but we did not take the trades.

XPO- we entered the stock long on Friday at 5425 and as the stock experienced a strong rally we sold ⅓ of the position with a quick gain of 0.70. This quick gain allowed us to raise our stop on the 2/3 balance of the position to a point that took the risk out of the trade.

On Tuesday, the stock opened below our stop of 5720 but we did not sell. Instead, we waited for the stock to settle down and then set the stop below the low of the day. The stock went on to recover from the initial weakness and then closed near the high of the day.

At the time of this writing, we remain long 2/3 of our original position and the stock is up close to $6 from our entry and nearly $3 higher than the stop!

GRUB is our second stock. This one is not quite as dramatic, but the principle remains the same, DO NOT THROW YOUR STOCKS AWAY AT THE OPEN!

The quick sale of 1/3 with a gain of +0.42 and then 1/3 stopped at 0.11 allowed us to absorb the stop on the balance for a loss of 0.57 which resulted in just over 1 penny per share loss! Keep losers small and ride your winners.

Please find a way to make sure your stops are entered AFTER the market opens. Overnight stops are often a license to have your stock stolen from you.