Picking bottoms (or a top) in a stock is one of the most difficult jobs on Wall Street and it is something which I rarely attempt to do. There is, however, one time of year that I have had success in finding deeply oversold stocks which have produced incredible short term percentage moves over the course of 2-3 weeks. Now is that time of year!

The best description of the “January Effect” comes from Wikipedia “The January effect (sometimes called “year-end effect”) is a calendar effect wherein stocks, especially small-cap stocks, have historically tended to rise markedly in price during the period starting on the last day of December and ending on the fifth trading day of January. This effect is owed to year-end selling to create tax losses, recognize capital gains, effect portfolio window dressing, or raise holiday cash. Because such selling depresses the stocks but has nothing to do with their fundamental worth, bargain hunters quickly buy in, causing the January rally.”

I do not think it is as precise as the last day of the year and then selling on the fifth trading day of January, but the reason in this description is valid (except raising holiday cash, do you sell your stocks so you can buy a nice present for your wife?).

Keep in mind that the stocks on this list are not in good technical condition, the charts all look terrible! Also, the fundamentals for these companies are probably lousy. These stocks should be looked at as HIGH RISK and you should consider buying a basket of them across different industries to spread the risk.

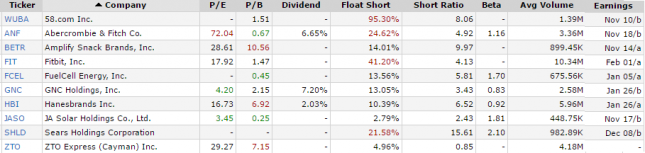

Below are the symbols for some potential beneficiaries of the January Effect. I have done zero fundamental research and I suspect that some of the names on this list will be bankrupt in 2017, they are just potential TRADING ideas. I wouldn’t buy and hold any of them.

To give you a rough idea of how these stocks were chosen, I started with stocks that were; down at least 40% over the last 52 weeks, trade at least 400K/day (20 day avg) and made a new 52 week within the last 2 weeks. I further refined the list manually, most notably I removed all biotechnology stock candidates (there were a lot of them) because when they break hard they typically get left for dead and do not experience the same type of bounce opportunity.

This list is a starting point. Be sure to do your own research and manage risk, worst case stops on any of them is to take out the 2016 low. I will be updating these stocks with specific buy points and stop levels for Alphatrends subscribers in the coming weeks. Good luck if you trade any of them!

BTW, the float short on WUBA doesn’t seem right (info from Finviz)