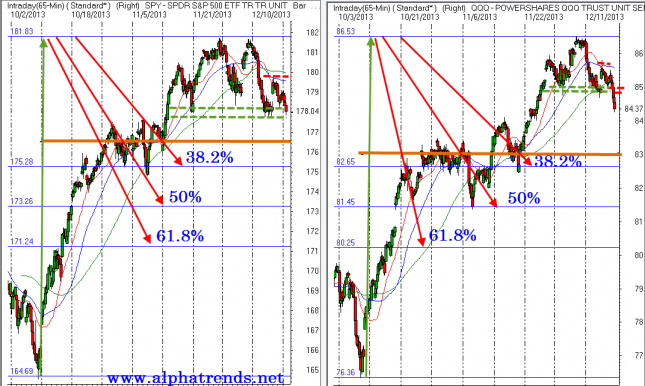

SPY – is below declining 5, 10 and 20 DMA, with the rising 50 dma below at 177.02. The important near term “band of support” is found between 17775 and 17825, that level is being tested now, a break below (which holds for more than a half hour or so) is likely to lead to test of 50 DMA with possible continuation down to the volume weighted average price (VWAP- represented by ORANGE horizontal line) from the October low through trading today. A move back up above 179.00 would turn this market more neutral.

QQQ – broke important support level between 8475-8500 and will have to reclaim that to become neutral, otherwise it is guilty til proven innocent in the intermediate term. The 50 day MA in the QQQ is at 83.19, the VWAP from the October low through today is also found just above 8300, this may be a support level on further weakness. Also of note on this chart is the head and shoulders patter which gives us a downside objective of 8300.