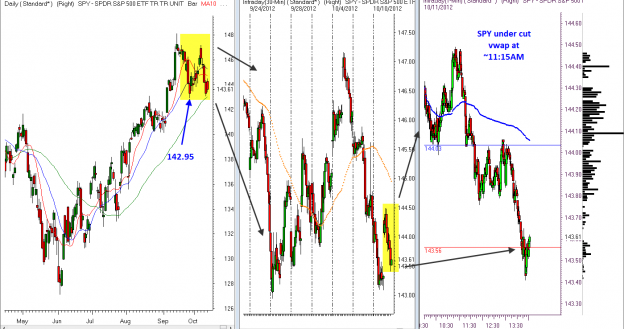

The scenario I OUTLINED about an undercut of the 50 DMA and the September 26 low of 142.95 looks like it could come to fruition as the morning strength has eroded since undercutting the daily VWAP at 11:15 AM. If the $SPY goes negative, it looks like we could see an emotional flush in the next day or two which would produce a panicky move down below those widely watched levels.

The relevant question on such a move would be “who is selling here after the decline the markets have experienced over the last week?” Not to question the intelligence of those who have stops placed under those levels, but it sure doesn’t seem like smart money making proactive decisions to manage risk.

If we are to see a move below 142.95 I will be looking for an opportunity to make an aggressive daytrade (and if the market allows me to hold by making higher highs and higher lows, I may hold some as a swing trade too) to the long side. An ideal scenario would be for a gap lower tomorrow morning and then to buy sometime after the market regains its vwap for the day. Things have to set up a bit here for this scenario to unfold but it seems like a reasonable expectation which I will be stalking. Don’t forget, Risk Management is Job #1 ALWAYS!