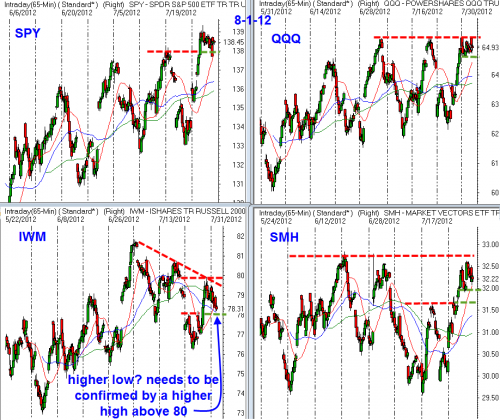

Pre-Fed the markets are positive and mainly constructive. The charts below show some key levels and observations for leading ETFs.

$SPY remains above the rising 5, 10 and 30 day moving averages and after a small shakeout below 138, it is back into a tight range which has been containing it for the last 3 days. This consolidation should be viewed as bullish as it occurs with in an environment with a rising 50 and 200 day moving average. A move back below yesterdays low would be our only reason for near term concern.

$QQQ has held onto the gains from last week real well and, unlike the last 2 attempts to push through 65, the market is holding onto its gains for a couple of days. A definitive push through 65 could get this market back up towards 66.50 Only a move down through 6450 would give us reason for concern.

$IWM remains the most suspect as there is a clear pattern of lower highs and lower lows which has developed over the last month. 77.80-78.00 has been a critical level for this market and we will want to see that level hold on any pullback. It will take a move back up through 80 to get this market back on bullish track and that doesn’t look likely in the short term.

$SMH experienced a strong move from support near 30 over the last week and a half and is now back up towards the high end of the range of the last 3 months. The 33-33.25 level was importand support from mid Jan through early May and it has been strong resistance since. It seems unlikely that this market will be able to push through that key area, so keep an eye on the low for this week near 3190, which is also the level of the rising 5 dma.

The message of the markets continues to be uncertain and in those times a strong defense is always best.