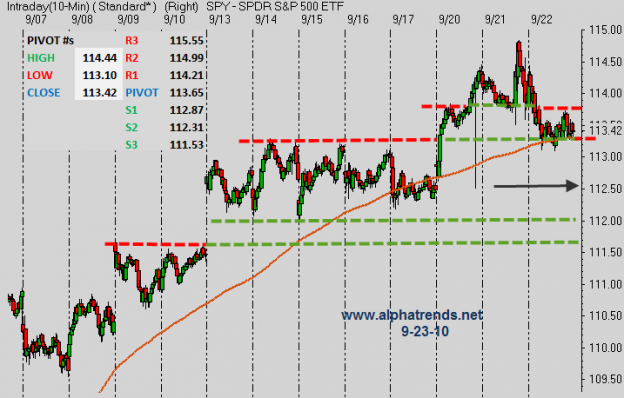

The SPY hadn’t broken the important 113.20 level yesterday, but it did give us reasons for concern (see video in post below). This morning the 113.20 level has been broken and it is now likely a level of resistance. This is why I spoke of using a hedge if you had long positions that you were unwilling to let go of. When the market is as overbought as it had become it is always prudent to lighten up your positions or to hedge them. We will look for a test of support ~112 and also be aware of the location of S2 and if things become worse, S3 lines up close to the 9/9, 9/10 highs. Initiating new swing trade longs while the market is declining doesn’t make sense, wait for signs of stability and that may take a couple of days. Defense!

This chart is constructed of 10 minute candles and shows the 5 Day moving average. The black arrow shows where the SPY is trading pre-market.

This chart is constructed of 10 minute candles and shows the 5 Day moving average. The black arrow shows where the SPY is trading pre-market.