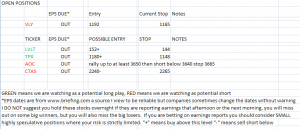

Subscribers see spreadsheet and video below{+++}

VLY stop should be 1185 NOT 1165, thanks

For anyone confused about the ICO and PLLL positions, please make sure you have read the FAQ section on the tab above. EVERY PERSON WHO SUBSCRIBES TO THIS SERVICE SHOULD READ THE “ABOUT” AND “FAQ” SECTIONS IN THEIR ENTIRETY BEFORE DECIDING TO TRADE ANY OF THE SUGGESTED STOCKS. In particular this question

For anyone confused about the ICO and PLLL positions, please make sure you have read the FAQ section on the tab above. EVERY PERSON WHO SUBSCRIBES TO THIS SERVICE SHOULD READ THE “ABOUT” AND “FAQ” SECTIONS IN THEIR ENTIRETY BEFORE DECIDING TO TRADE ANY OF THE SUGGESTED STOCKS. In particular this question

What is the point of the “B-list stocks” versus the main ones on the watchlist?

The “main watchlist” is meant to focus your attentions on what appear to be the highest probability/ low risk setups, these stocks show the suggested entries and stop levels on the spreadsheet as they were analyzed and explained in the daily video . The main stocks are brought to the forefront after manually analyzing scores of stocks on multiple timeframes. If there are an abundance of setups that appear to have a reasonable chance of trend continuation, the other symbols will end up on the “B-List”. Many times there are some excellent movers on the “B-List” and they are brought to your attention so that if the main stocks do not trigger trades there will still be opportunities to cull from through the trading day. If you choose to trade the “B-List” stocks you will be completely on your own as time does not allow for a complete analysis of such a long list of stocks. The idea is to “make each trade your own” with the analysis techniques discussed in the videos.

Both ICO and PLLL were “B-List” ideas and I did not twitter the exits, I did mention stops for both of these stocks in the Thursday June 11 wrapup video. Please review ALL posts and if you have a question about stops I am always happy to help, but please do not ask me what to do if a stop has been violated and you are still holding. My answer will be “get out, the stop has been violated otherwise you are taking WAY more risk than I think is acceptable”.