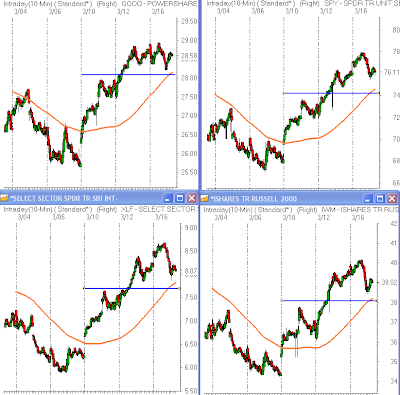

The markets are digesting the gains of the last week above the rising 5 day moving averages (orange line). The blue lines on the charts below are the VWAPs since the uptrends began one week ago today. The average price from the rally is a key intermediate term psychological level as it represents the average price for longs and shorts for that period of time. Holding above VWAPs could get shorts to reconsider their bets and cover which would entice more sidelined cash to the long side. Falling below VWAP may cause shorts to get more aggressive as they realize they have won back control of the trend and further pressure would be added as longs liquidate. The trends on longer timeframes are still lower so odds favor a failure but the message isn’t clear enough at this point to be aggressive either way. When there is no clear edge, cash is a position if you are not skilled enough to scalp on shorter term timeframes.