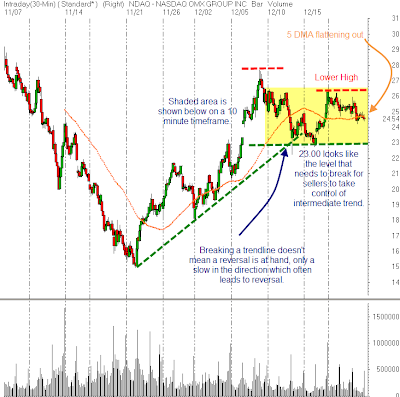

The BERNIE MADOFF drama continues to unfold as victims of his swindle are revealed, it is truly a sad story and another black eye for the financial industry. The true level of deceit is expected to take years to unravel and the biggest beneficiaries will likely be lawyers who are undoubtedly billing massive hours as they work to recover funds from anyone remotely connected to the scheme. It seems pretty obvious to me that the Nasdaq (NDAQ) will come under scrutiny as old Bernie was the former Chairman of the Nasdaq. Whether or not the Nasdaq has done anything wrong isn’t the point. There could be a growing suspicion of the publicly traded company which could result in a lack of shareholder confidence that leads to a liquidation of NDAQ shares of what holders may think is a tarnished company. Also, as the bear market wears on, trading volumes are likely to drift lower which could also be another fundamental reason to think that NDAQ could be a good short candidate. A good story (or in this case a bad one) is never a reason to get involved in a stock without studying the technicals first. So let’s look at some charts using MULTIPLE TIMEFRAMES below.

WEEKLY TIMEFRAME

Shares of NDAQ are below the declining 10, 20, 30 and 40 week moving averages, the sellers are in control of the longer term trend.

So, how to play this? Well that is up to your own personal risk tolerance, time horizon, etc. I am considering buying puts 2-3 months out, maybe the March 22.50’s (bid 2.60 offered 2.75) and trading the stock short on a daytrade/swingtrade basis. To me, the stock looks like it could drop to 12-15/share once it really gets going. The idea would to have a core short position via the puts (which limits risk) and to pay for those puts with trading profits. Risk Management is Job #1.