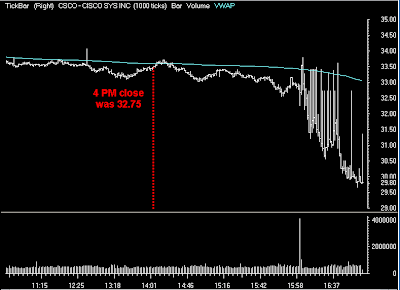

In order to suceed in the markets you have to ANTICIPATE and MANAGE RISK. Anticipate does not mean try to catch the falling knives, but to recognize signs in the market where there may be a potential turning point. Recently, the biggest signs of trouble came from the Financials (XLF) the Semiconductors ($SOX.X) and, more broadly, the Russell 2000 (IWM). The signs of excess speculation were also obviously present in the riduculous advances experienced my many small Chinese stocks about a month ago, then Warren Buffet said he was selling his Petrochina (PTR) shares (they’ve since dropped about 50 ponts). Then we saw many leading stocks get hit hard with out any signs of bouncing (ABK, BRCM, C, CMCSA, CROX, EBAY, ERIC, HANS, GRMN, MDT, NTRI….etc). I have been saying that a move to the 50 day MA on the QQQQ would not come as a surprise, but what does surprise me is how quickly we may see such a move. Cisco Systems (CSCO) reported after the close today and the reaction to the numbers is terrible. I didn’t bother to read the news, one look at the stock tells me all I need to know. I am happy to see the many emails and comments from people who reduced their long exposure or got short based on what I have been saying the last few weeks. So what to anticipate now? More turbulence with a downward bias, if you are still heavily long I would use any bounces to reduce exposure.