The 50 day MA on the Qs is way down at 50.00, I am not expecting it to drop to that level today but the short term trend is lower and where support is found is anyones guess. We can use tools like Fibonacci, moving averages, measured move, etc to approximate where support may be found, but wait for price action to confirm support has been found before making purchases.

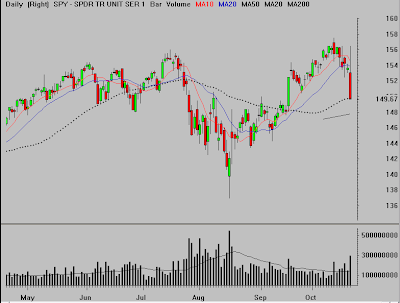

The 200 day MA in the SPY is found at 148, that is a more realistic approximation of where the market may potentially find support today. Do not blindly buy at levels that you think should be support, let the institutions do the dirty work of creating those support levels with their massive firepower and then once the trend has revealed itself, step aboard for a quick move and keep a tight stop in case the sellers come back. There is no such thing as “down too much”, compared to what?

When you have time check out the Blackberry controversy on WALLSTRIP