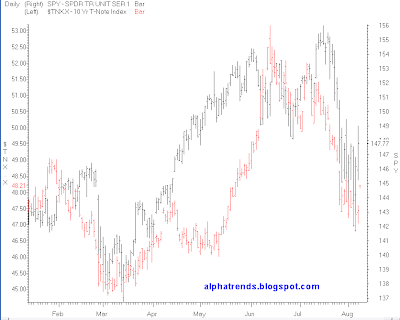

Markets don’t always do what they are “supposed to do”. It is conventional wisdom that stocks and bond yields move in an inverse relationship. From the beginning of the year the general trend has been that when yields rise, so do stock prices. And when yields fall, so have stocks. The point is that learning economic theories and models are interesting and will get you a passing grade in Economics classes but in the real world those theories don’t always play out. Focus on price, it is the only thing that pays. If you trade bonds, pay attention to bond prices. If you trade equities, pay attention to equity prices. It doesn’t mean you shouldn’t be aware of the inter relationships between markets, but a pricing theory should have little weight when it is not backed up by price action.