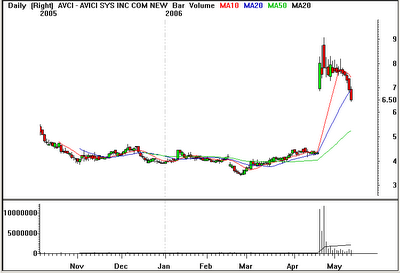

Futures are pointing to a gap lower (Nasdaq by more than 0.5%) and that makes it too risky for me to post any swing trade ideas, long or short. The QQQQ closed out 2005 at 40.41 and they are trading at 40.53 right now, can the bears push it to negative on the year? Remember all the talk about how great the first quarter was? Only the most aggressive traders should attempt to trade today and if you are on of them, be extra aggressive with your money management. I will have my eye on some high volume (2o day average of more than 2 million) , high relative strength stocks (at least 90) which are down more than 10% this weeek. It is a short list of stocks that I think are most likely to bounce aggressively if the market is able to stage a reversal after the initial panic selling. The stocks are ATHR, AVCI and OVTI. One thing I will be looking for in these stocks is an inital selloff, hopefully down towards daily S2 followed by a lower volume intraday test of that initial low and then a 10 minute high, a stop would then go a few pennies below the daily low (hopefully no more than $0.25 or so). If this situation unfolds in any of these stocks I will post a chart later to show you the setup. Remember trading today is HIGH RISK and these are not recommendations, they are just a few stocks that might make for a good daytrade.

ATHR (click charts to enlarge)