Shares of CPST are consolidating after yesterday’s high volume break past 4.00 and so far there is no reason to think that the bears have wrestled control of the stock back from the bulls. The prior resistance at $3.95 from March 29th should act as support on this pullback, to be safe a stop should go a couple of pennies below that level to give it a little wiggle room.

PLUG gapped higher and made a quick extension of that strength, but unless you were quick you are likely down in the stock as it remains below the daily VWAP of 6.09 at this time. The stock is also back below the declining 200 day moving average (now found at 5.85). A declining 200 day MA indicates longer term selling has not yet been fully resolved, I would continue to stay away from this one.

MCEL just isnt ready to go yet, it has to clear that 200 day MA at 1.69 and take out the recent high of 1.70 before it can gather any momentum worth trading. I am out at break even.

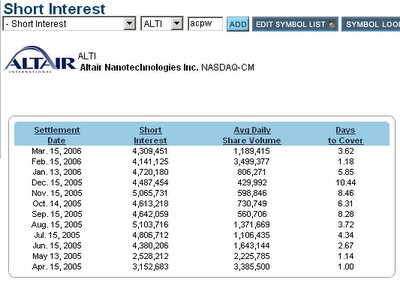

ALTI has pulled back to the bottom end of its recent trading range and is worth buying at currrent levels (3.83) with a tight stop at 3.68. Here is an excellent article outlining the bullish case from The Streeet http://www.thestreet.com/_yahoo/pom/pomsut/10275369.html?cm_ven=YAHOO&cm_cat=FREE&cm_ite=NA

There is also a fairly large short position in ALTI adn with the stock near 52 week highs you would imagine those shorts are feeling anxious.

ACPW continues to hold up real well.