The $SPY and $QQQ are struggling below the 2020 election anchor (VWAP) with the $IWM giving back all its election gains, indicating broader market weakness.

A lot of individual stocks and educational concepts were discussed

📷 High-flying stocks with 15%+ average true range (ATR) are experiencing significant corrections, exemplified by SoundHound’s 40% drop from $25 to $15 in just two weeks.

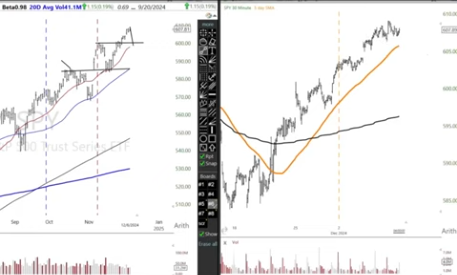

📷 Short-term traders should seek buy opportunities above the daily VWAP and 5-day moving average, while long-term investors should wait for a bounce to the 50-day and then 20-day moving averages.

📷 Volume expansion at turning points and contraction on retracements is a fractal pattern observable in both 1-minute and daily charts, signaling strong trend