Signup for the Bundle sale here Use coupon code 57BDAYBUNDLE

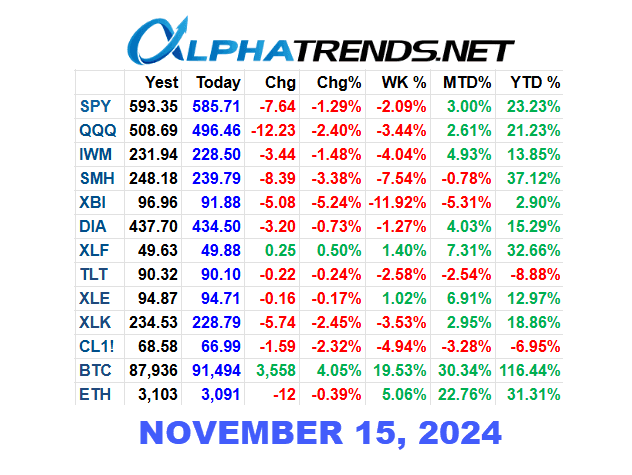

Profit Taking: The week saw significant profit taking with $XBI stocks down 12% and $SMH down 8%. The S&P 500 also experienced a decline to a prior band of resistance.

Technical Indicators: The declining five-day moving average. This suggests a bearish trend, as noted by the speaker's caution against trusting rally attempts below this average.

Short-Term Market Expectations

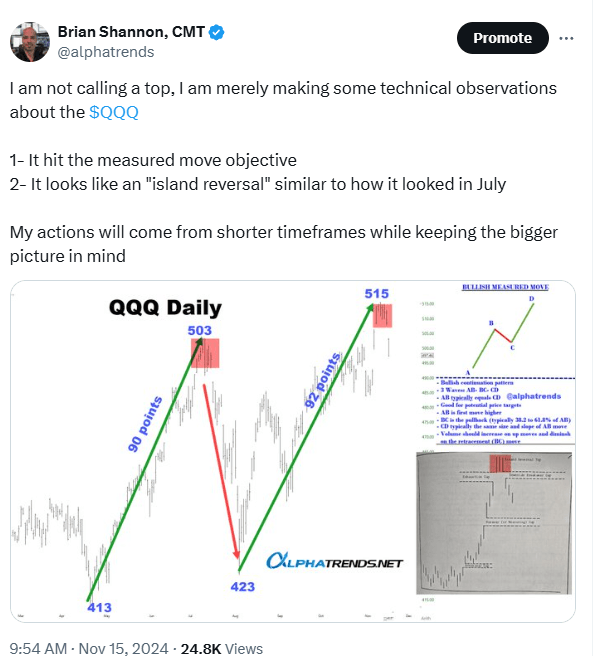

- Levels of Interest: $QQQ might continue to move lower towards the 50-day moving average and the anchor off the September low.

Market Psychology: $SPY Emphasizing the market's tendency to sell off after breaking below support levels, complacency is warned against. There is an anticipation of continued market weakness into next week.

Individual Sectors and Stocks

$XBI: Once seen as a potential leader for market recovery, biotech stocks are described as "broken" and are recommended to be avoided until they show signs of recovery.

$TSLA Despite recent neutral performance, Tesla is expected to potentially rally mid-to-late next week. However, caution is advised as it remains under a declining five-day moving average.

Cryptocurrency Insights

#Bitcoin: Despite skepticism about traditional indicators like the golden cross, Bitcoin is performing well and maintains strength above key anchored levels, suggesting bullish sentiment.

#Ethereum and #Solana: Both cryptocurrencies are observed for technical levels; Ethereum bought at the election anchor suggests a strategic entry point while Solana also shows potential for buyer interest at similar levels.

Bond Market Analysis

- Interest Rate Cuts: The Fed's rate cuts have not translated into lower bond yields, emphasizing that the bond market, not central banks, dictates interest rates for consumers. $TLT

- Current Trends: As the bond market remains in a downtrend with declining moving averages.

Closing Remarks and Offers

- Trading Strategy: Emphasis is placed on the importance of not buying dips in a declining market, but rather buying strength after dips when confirmatory signals are present.

- Alpha Trends Offer: To celebrate the speaker's birthday, a sale is offered for Alpha Trends subscribers providing trading courses, daily stock analysis videos, and webinars, emphasizing education on consistent trading methodologies.