As we approach earnings season, I will be listing the stocks in the table by earnings dates. It is the most important number on that table because of its potential for impact on price around earnings dates.

0015: Stock Idea reviews

1749: If stock makes a new high at a good buy point with a relevant low, using stop 10¢ away. If you can justify on the chart, use it.

1856: What is the turnover like on your master list? How do you manage the list? Each stock on its own merits not on a sector.

2016: AVTR review. Gap down to R2/S2 invalidates the trade.

2327: Day trading is risky. Advises people not to do it. Most people lose money in it.

2634: Investors use 50,100,200MA's we use 5,10,20MA's. Brian does not tape read.

Does look at action around those longer term MA's.

3004: Review of risk units. Max 1% on an A-list idea. More important is how tight the stop is.

3406: When Brian does an interview, he will post it for subscribers to see.

3501: See ATR on the screen. Do you use it? Generally No.

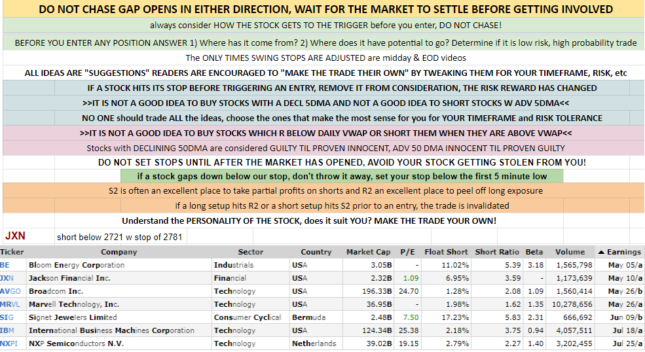

3605: Using pivot points, do you buy off of R1 even if it is below the Daily VWAP? No. Don't

buy below the VWAP and don't short if price is above VWAP.

3719: CAL trade. Passed on the trade as it ran past R2. Invalidated the trade.

3932: CRDO. Moving up stop when entering on moving above the VWAP.

4105: Any emphasis on the futures market? Not with a 5 DMA. Can use the VWAP.

4243: Never use advance/decline line. Or new highs/lows.

4354: What do you look for to put a stock on your watch list?

4536: Shorted Blackrock on the 50D MA. Would not time decisions on the MA's.

4930: Brian does not keep statistics on the trades because everyone should be "making the

trade your own". Brian is not selling performance. He is trying to teach you to become a

better trader.

5059: PERI. Daily volume is too low so I will not answer the question.

5158: About the book. Pre order books will be signed. Available for print by December.

Trying to get it moved up to an earlier date.(Let's hope).

5310: Uses pivots on intra-day only. And a 5min time frame.

5343: Chapter 7 on the intermediate course. See charts for which MA's he uses on each of the

time frames.

5446: XLE as an example of if it's in a pullback or a Stage 4 downtrend