Picking bottoms (or a top) in a stock is one of the most difficult jobs on Wall Street and it is something which I rarely attempt to do. There is, however, one time of year that I have had success in finding deeply oversold stocks that have produced incredible short term percentage moves over the course of 2-3 weeks. Now is that time of year!

The best description of the “January Effect” comes from Wikipedia “The January effect (sometimes called “year-end effect”) is a calendar effect wherein stocks, especially small-cap stocks, have historically tended to rise markedly in price during the period starting on the last day of December and ending on the fifth trading day of January. This effect is owed to year-end selling to create tax losses, recognize capital gains, effect portfolio window dressing, or raise holiday cash. Because such selling depresses the stocks but has nothing to do with their fundamental worth, bargain hunters quickly buy-in, causing the January rally.”

I do not think it is as precise as the last day of the year and then selling on the fifth trading day of January, but the reason in this description is valid (except raising holiday cash, do you sell your stocks so you can buy a nice present for your wife?).

Keep in mind that the stocks on this list are not in good technical condition, the charts all look terrible! Also, the fundamentals of these companies are probably lousy. These stocks should be looked at as HIGH RISK and you should consider buying a basket of them across different industries to spread the risk.

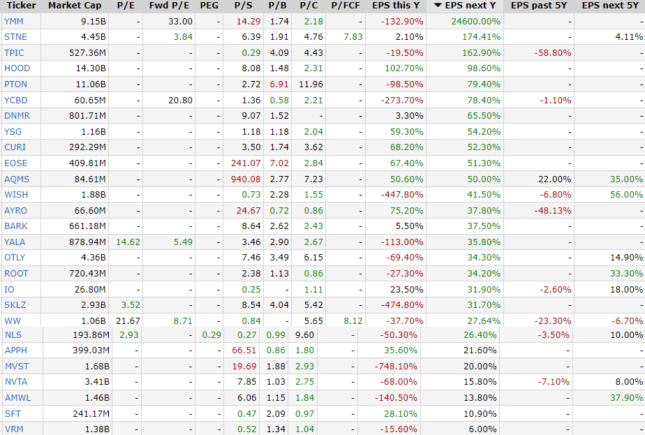

Below are the symbols for some potential beneficiaries of the January Effect. They are just potential TRADING ideas. I wouldn’t buy and hold any of them.

To give you a rough idea of how these stocks were chosen, I started with stocks that were;

- down at least 75% over the last 52 weeks,

- trade at least 500K/day (20-day avg)

- made a new 52 week within the last 2 weeks,

- at least 5% of the float short,

- optionable

- positive expectation for earnings next year.

I further refined the list manually, most notably I removed all biotechnology stock candidates because when they break hard they typically get left for dead and do not experience the same type of bounce opportunity. I also removed all China related names, commodity related names and ETFs.

This list is a starting point. The goal is NOT to buy the low of these stocks, but to treat them like broken stocks which are beginning to heal and then manage risk. Be sure to do your own research and manage risk, the worst case stops on any of them is to take out the 2021 low. I will be updating these stocks with specific buy points and stop levels for Alphatrends subscribers in the coming weeks. Good luck if you trade any of them!

See the video for details. This is the FIRST ROUND, I will be whittling them down and wanted you to see the process. Maybe there are one or two that don't make it to my favorites but you like them? I promise I will not pick all of the best ones, I wish I could but I am realistic.