Technical analysis is often criticized because it “is great at predicting the past” or some similar argument. Without starting a debate about the merits of a technical vs fundamental approach to the market (which is a foolish argument to begin with) do what works for you! I wanted to point out that we are NOT trying to predict, but to ANTICIPATE what is likely to occur in the action of the stock or market we are looking at. We use technical analysis as a way to objectively (if we are doing it correctly) analyze price action and then come up with a trading plan based on how the stock actually trades.

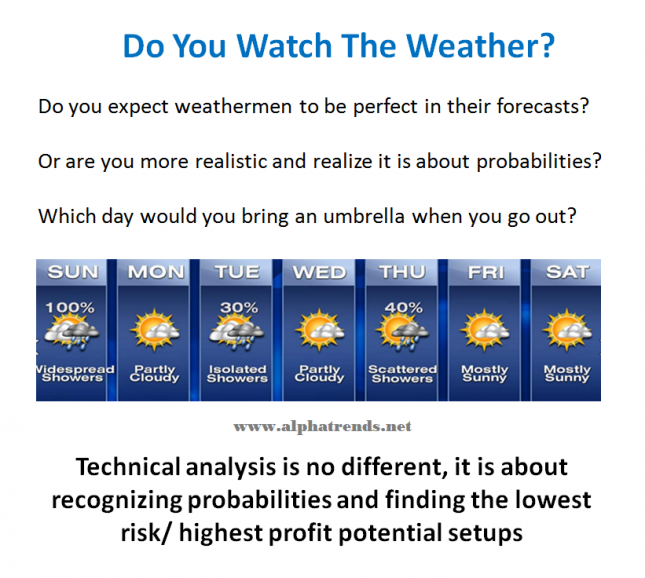

Do you watch the weather? At some point, everyone complains about how “the weathermen never get it right!” If you were told there was a 20% chance of rain you would probably think that the risk of getting rained on is small enough to not take an umbrella with you outside that day. If, however, the weather person saw a 100% chance of rain you would probably determine that the reward of not carrying an umbrella around is not worth the risk of being rained upon.

Technical analysis is no different. We are not looking to be perfect but to assign probabilities which help us determine if the risk of getting involved in a stock is worth the potential reward. It adds structure to our plan, how could that be harmful?