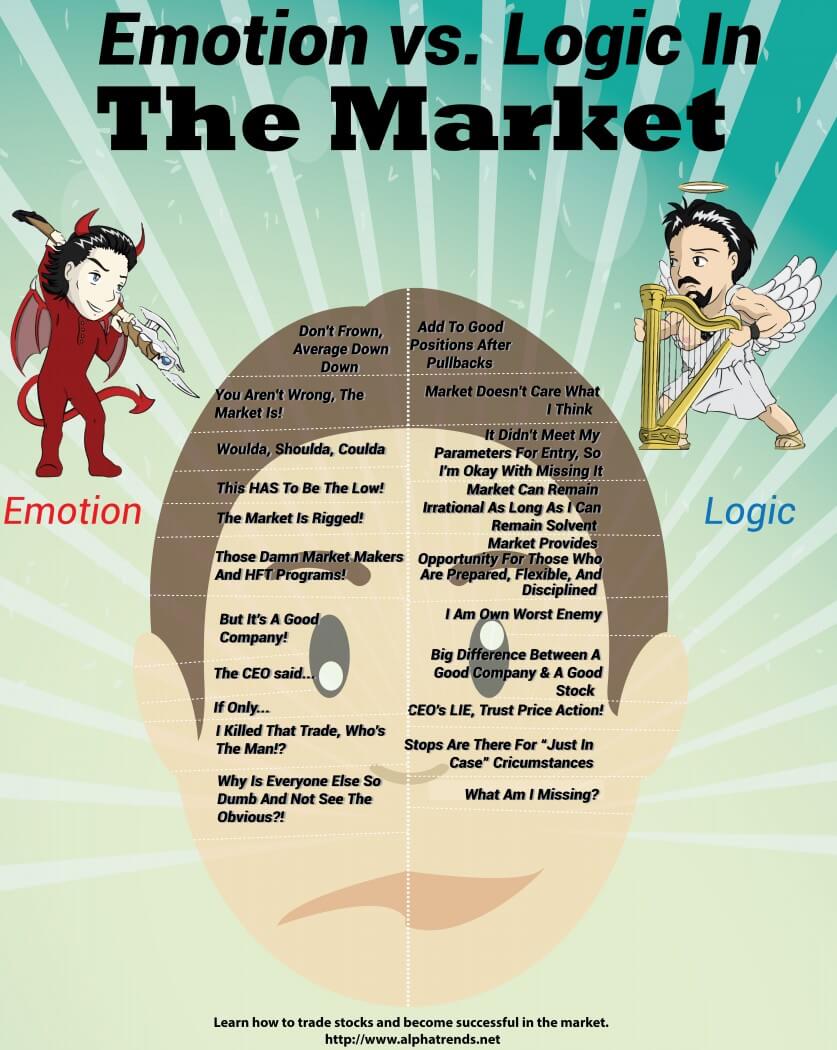

See the below Infographic “Emotions vs. Logic In The Market” to visualize differences between emotional traders and a more successful objective approach

If your anxious and your heart is beating when you’re in a stock, your position size is most likely too large. Fear and greed the two strongest emotions that can and will negatively impact your trading success, usually in a negative way..

Fear – Distress Over Losses

Psychologically, our minds process losses as more significant than a gain of the same amount. In trading, our fear of being wrong will often be used as a reason for staying in a losing position which leaves our accounts vulnerable to larger losses.

The most important part of trading is risk management. If you have a consistent and objective approach to risk management it will allow you cut your losses fast, and hold on to your profits!

Greed – Batting For Home-Runs

Coulda, woulda, shoulda. Those are 3 words that you should eliminate from your trading vocabulary, as they are most often associated with home run trades you missed (hindsight is always 20/20). There are thousands of stocks to choose from – don’t get distracted by potential home run trades. Instead, focus on being disciplined and consistently extracting profits from stocks. No one gets all the winners, focus on your process.

Logic – Remain Disciplined

Before you enter a stock, make sure you have a solid plan for every stage of the trade life cycle. This means knowing your entry, initial stop level, potential price targets, size of the trade and trade management. Once you have a position in a stock you need to manage the trade based on “the message of the market.” Stick to your methodology and never drift from your initial plan.

Another Example Of Logic – Let Your Winners Run!

Once involved in a stock, it is absolutely essential to let the setup work as you planned instead of falling victim to emotions and making irrational moves. Don’t succumb to the fear of giving up your gains because of minor dips throughout the day. Letting your winners run will allow you to maximize your gains in the long run.