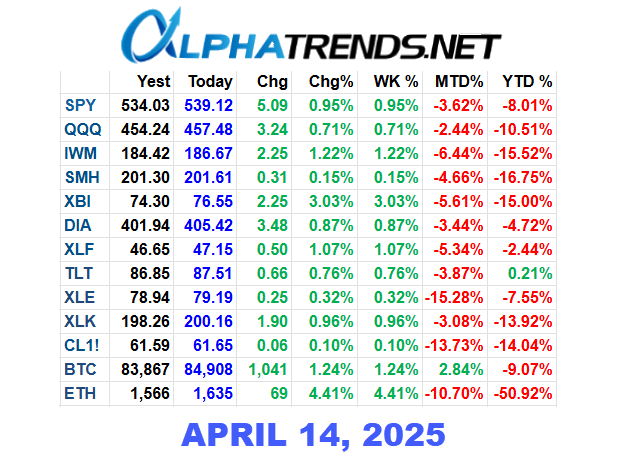

Monday, April 14 – Markets finished higher on the day, but the move was mostly from the morning gap, with indices stalling just below key levels like the daily and week-to-date VWAPs. We're still below declining 20- and 50-day moving averages and at potential supply zones like the two-year anchor and the anchor from the all-time high. While the 5-day moving average is rising, this remains a bounce within a broader downtrend, not a trend reversal. Expect possible short-term strength or even a slightly higher high, but the setup still favors a pullback mid-to-late week if price gets trapped under key levels. Volume is thinning out on these rallies, which further supports a distribution thesis. If you're long, know your recent higher low to protect profits. Biotechs and financials are pushing toward resistance, semis could trap breakout chasers soon, and names like Palantir and Apple are running into prior supply. Overall, it’s still a day-trader’s environment with few high-conviction setups for swing trades.