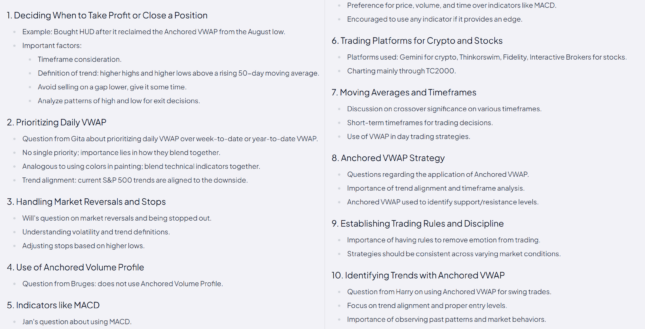

Thursday, April 17 - This session emphasized the importance of timeframes, trend definitions, and exit planning based on high/low patterns. No single VWAP is prioritized—daily, weekly, and year-to-date all blend together depending on context. Anchored VWAP is key for spotting support/resistance, and traders should align with broader trends. Indicators like MACD are optional; preference goes to tools that offer an edge. Most use platforms like TC2000 or Thinkorswim. Discipline and consistent rules matter most, especially in volatile markets. Ultimately, success comes from reading patterns, respecting moving averages, and understanding when trends shift.