So you did your nightly research and found what look like some great potential movers for the next day of trading. The next morning you are anxious to take advantage of all the great setups but you look at your stocks and see that some of your strongest trading candidates are gapping higher. We’ve all had this happen and the temptation to chase price higher can seduce even the most disciplined trader to lose his cool and pay up for the stock. Although there is always the exception to the rule, it is usually a suckers bet to purchase the stock as it gaps up.

I’m not a quantitative analyst who studies how often certain stocks will continue higher, close their gaps or fail altogether. I am a trend trader who likes to trade in the direction of the momentum if it is backed up by a trend from a longer timeframe. But there are guidelines to when I purchase these stocks. The best way I can show you how I like to treat these scenarios is to go through some real life examples. Two weeks I identified some stocks which looked to be good trend continuation candidates, included in the list were shares of China Bak Battery (CBAK) and Beacon Power Corp (BCON). Below is a look at multiple timeframes for these two stocks to see how I like to enter stocks which experience a gap in the anticipated direction of my trade in a disciplined manner.

EXAMPLE #1 CHINA BAK BATTERY (CBAK)

The daily chart of CBAK shows a stock which recently cleared a six month level of resistance near 4.75 (also the location of the 200 day MA) on a surge in volume. The stock held the gains nicely and with a rising 10, 20 and 50 DMA, it looked poised to continue higher.

The 10 minute chart of CBAK shows buyers becoming slightly more aggressive with the higher lows as the stock holds above the rising 5DMA. The short term resistance level at 5.08 has prevented the stock from making a higher high. Purchasing above that level would allow for a low risk momentum entry with a stop just below 4.95.

Shares of CBAK opened at approximately 5.20 on Monday morning, with a stop level just below 5.00, the perceived risks have now more than doubled which makes chasing it higher out of the question. You can see the gap higher quickly failed and the Volume Weighted Average Price (VWAP, represented by the dotted moving average) was steadily declining up until about noon eastern. Late in the day, the stock finally managed to take out the high made just before noon at approximately 5.14.. This is the point where buyers were back in control of the trend as the average price was now lower than current levels, this is where I purchased the stock. You can see that once the buyers regained control for the day the stock surged higher. At this point, the daily, 10 minute and 1 minute timeframes were “aligned” which makes the stock a good candidate for continued higher prices.

EXAMPLE # 2 BECAON POWER CORP (BCON)

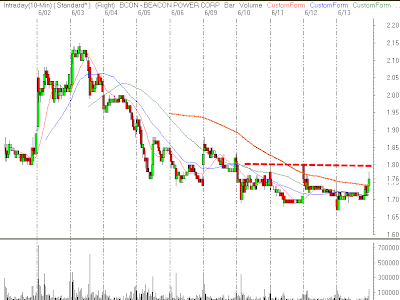

Shares of BCON have shown an excellent pattern of large volume rallies followed by low volume consolidations. The first price surge found support just above the rising 10 day MA, while the current pullback shows the stock stabilizing above the rising 20 day MA.

The 10 minute timeframe for BCON shows that the short term downtrend seems to have run its course. Purchasing during the neutral period between June 10 and June 13 offers a momentum based trader no edge as the buyers begin to gradually wrestle control from sellers. A move back above 1.80 puts the buyers firmly back in control.

Here we see the 1 minute chart for BCON. On Monday morning, the stock opened at 1.84, which was above the desired entry at 1.80. I decided to watch the stock to see if it would experience a small pullback. The stock did pullback, but I did not purchase on weakness because you can never be sure if the stock will continue to grind lower and leave you with a losing position. Instead, I monitored the stock closely and waited for buyers to take control of the trend again, as the stock crossed back above the daily VWAP I purchased at 1.84. You may be thinking I didn’t do any better than those who bought the stock on the open, but there is a big difference. I allowed the natural profit taking to occur and the waited for buyers to regain control so I could purchase when there was momentum. You see, there are two forms of risk in the market; price and time. Why let the stock pullback and hope the buyers will re-emerge? Why wait for the buyers to show up? Instead the better bet is to wait for evidence the buyers have retaken control ant to then buy on strength just as the stock regains its momentum.

I hope the concepts in this brief article give you some insight trading with multiple timeframes and recognizing when the balance of power shifts from sellers to buyers with VWAP. It these concepts are new to you be sure to check out my just published book “Technical Analysis Using Multiple Timeframes” The book is available exclusively at www.technicalanalysisbook.com