Maximum Trading Gains with the Anchored VWAP results from decades of research and application by the author. It builds on Shannon’s foundational book, Technical Analysis Using Multiple Timeframes.

Author Brian Shannon, CMT, explains how to use the Anchored VWAP (AVWAP) to make better entries and exits, to time breakouts and breakdowns, and to set stop losses. Both new and experienced traders and investors will appreciate the book’s insights and systematic approach to using AVWAP in a variety of situations including IPOs, support and resistance, market direction, short sales and squeezes, and financial news.

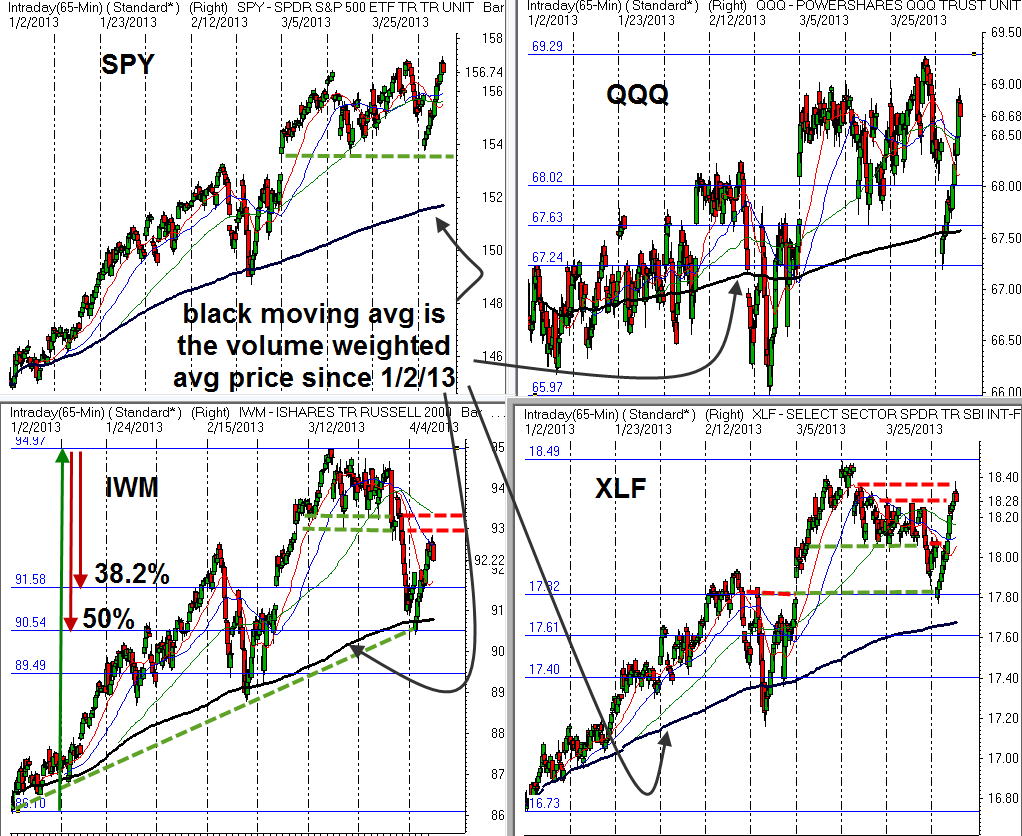

In the author’s words, “The AVWAP represents the absolute truth of the relationship between a stock’s supply and demand, and is 100% objective.” Every chapter includes solid advice on managing risk, which Shannon emphasizes throughout the book, “is Job One.” Shannon is a trader’s trader who avoids jargon. The book offers over 145 color charts, tables and case studies to set out a definitive framework for understanding the three most important components in the market: price, time, and volume. Readers will learn to work with the market’s psychology and their own.

Amazon Book:

https://www.amazon.com/Maximum-Trading-Gains-Anchored-VWAP/dp/B0BLZMMLLJ

Google eBook:

The eBook is on Google Play in 70 countries.

bit.ly/3JHjWoY

Apple eBook:

The ebook is on Apple in 18 countries.

apple.co/3IvkNrX