0020-Review of Current positions.

ATEN-may add back to position if it breaks out.

0433: DO NOT SET STOPS BEFORE the market opens!! Wait a few minutes before

setting.

0720: Brian does not like to trade a stock if there is an underlying commodity attached to

the stock. Because you have the possibility of hedging.

1300 VSTO- Good example of how Brian evaluates a stock.

2300 BE- Brian using this stock to discuss alternative types of entries.

2550 CMS - Evaluation of the stock

QUESTIONS

3015: Getting TC200 to build alerts for AVWAP. Not interested in doing.

3108: AVWAP Trendline important? Yes-tells you who is in control and where the buyers and

sellers actually are. Anchor point is placed at a point where momentum shifted based on

an event that occurred at that point.

3353: What do you mean by "the stock is not ready yet"? Has to do with several variables: such

as is the 5DMA turning up yet. Explains in each video when he reviews the stock. Each

stock has a different set of particular reasons.

3519: Does not use overnight stop loss. Set after the market opens.

3640: Position sizing. Brian gets in 100% at the entry. But he will adjust (sell a portion of the

position) as the stock reacts after the entry. He does not scale into a position.

3858: Brian will set alerts to let him know to watch the stock closely as it approaches a level

where he might want to exit the trade. But does not set a stop before the market opens.

4100: What percentage of your account are your A trades? Can be up to 25%-depending on

market conditions.

4205: Where does Brian get his media information? He is aware of the dates where there are

catalysts that will affect the market (eg fed announcements). Some information comes

from SeekingAlpha-whats ahead for the day. Axios Market. Really does not follow the

news, Just look for major catalysts.

4352: Active forum to share ideas? No. That is not his goal for this service. Chat rooms tend

to hurt people.

4609: 2 Minute Rule. In stock that is running in the AM ( first "2 minutes " of

the session), instead of taking profit at R2/S2, follow the trend raising stop bar by bar.

Examples can be found in the search box on the website.

4809: Candlestick patterns. Brian has very little use for them. Books recommendations: William

Jiler How Stock Can Help You in the Stock Market.

4945: Disparity between the Daily and the Intraday chart.

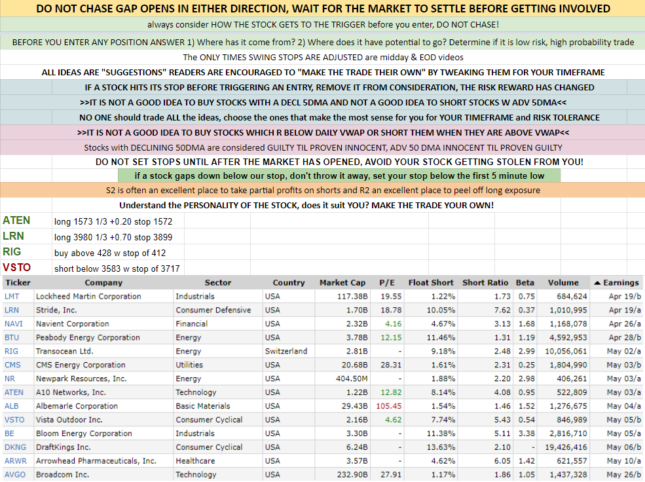

5102: Stock suggestions are listed by earnings dates. Most recent first.

5240: Using ATR minimum for swing trade? Does not use ATR at all.

5345: Question about a 60 Month exponential MA. This is something someone else uses and

Brian has no comment on it.

5431: INVZ-evaluation

5610: ADBE evaluation

5747: Which Pivot does Brian use? Standard Floor Trader Pivots

5858: Hitting R2/S2 before the entry invalidates the trade.

10007: Equity curve strategies. No suggestion.

10102: How do you know it's a SPAC? They typically open at $10.00 level.

10207: Brian only looks at the 1BShannon@gmail.com for the Webinar. This is the place for

educational questions. Support questions should be sent to support email. Questions

about individual stock should be posted on the forums.

Old videos can ONLY BE accessed through the website. They are hidden from public

view otherwise in Vimeo.

10409: Question about using Putt/Calls strategies. Brian does not use this type of

trading. Brian's hedge is getting out of the trade. Does not use puts/calls.

10632: Missing the entry due to spotty real time trade data? Can you still re-enter at a later time

using the same entry recommendations? DON'T TRADE with spotty data.

10745: XLU evaluation.