“We also need to accept the fact that no trading system is right all the time, and because of that, we will be wrong sometimes in our direction to trade, even if we do everything right. Being wrong is part of the game; how we prepare to meet those times is directly related to our account balance”

“As retail traders, we would be wise to remember that we are competing against world-class organizations and institutions, against the best and brightest people and machines. Never forget who your competition is.”

“Trading is a thinking person’s game, and if we do not have the ability to reason through what we might see within the charts, we will consistently have difficulty in the field.”

These are not quotes from a compilation of Warren Buffet annual reports, that is obvious because good old Warren is an investor and certainly not a retail trader. The words above are from someone whose books I consider required reading if you are interested in not only competing against the brightest people and machines, but actually beating them.

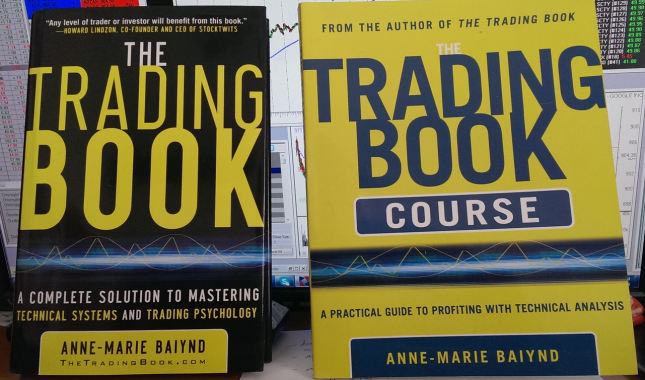

It is possible to consistently make money in the markets but it takes work, a lot of hard work. Anne Marie Baiynd is a great student, trader and educator who has achieved consistent success in the markets. Her two books will help you learn the tools to create your own success. In an industry dominated my men, Anne Marie’s talents as a trader are uniquely articulated from a female perspective which is not only refreshing but is quite insightful.

These two books are not only filled with great quotes like the ones above, but more importantly, they have actual trading concepts which can help you make money! I like the theoretical side of Wall St. to a degree, but theories don’t pay the bills. Well thought out strategies which are implemented with discipline are what allow our accounts achieve all-time highs regardless of what the market backdrop is.

With a background in mathematics, common sense, sound logical reasoning and a well lived life, Anne Marie does a great job of conveying some advanced concepts in an easy and fun (yes market books can be fun) read. She does a great job of using sports metaphors, motherly wisdom and an honest vulnerability which is often not seen in such a “serious” subject. The fact is, markets are serious but the human element is one which is overlooked in the “HFT, algo” trading we read about so often. If you take trading seriously enough to still be reading you should buy these books.

USE THESE LINKS TO PURCHASE THE BOOKS ON AMAZON

THE TRADING BOOK: A COMPLETE SOLUTION TO MASTERING TECHNICAL SYSTEMS & TRADING PSYCHOLOGY