A subscriber recently asked me if I knew of any high yielding stocks he could suggest to his mother for some income. I told him there were none that I was aware of offhand but I would do a scan using www.alphascanner.com and come up with a list.

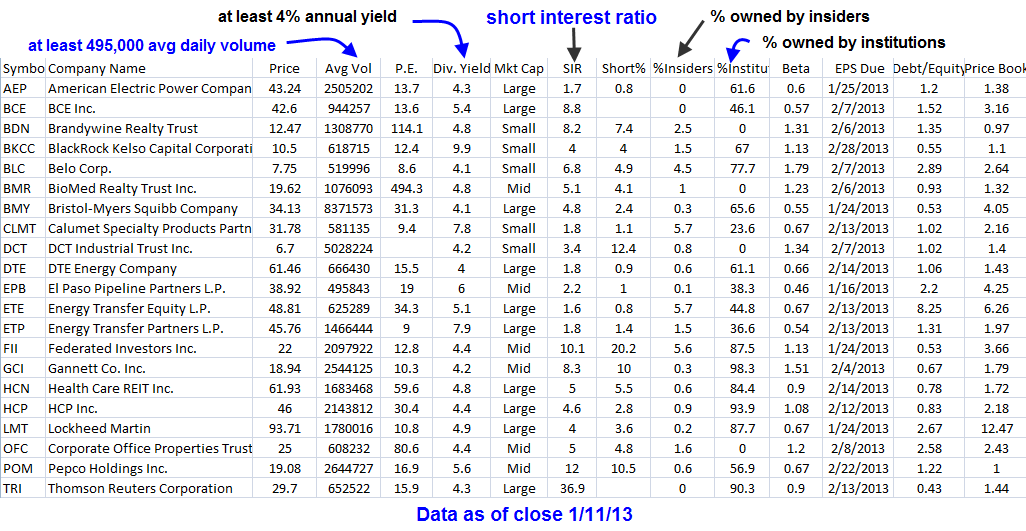

The table below shows stocks which have an annual dividend yield of at least 4%, the average daily volume is at least 495,000 shares and the charts are generally stable to uptrending. Any stock in a downtrend (daily or weekly) was eliminated from consideration as safety of principle for a retired person should take precedence over the lure of a fat dividend payment. What good does it do to wait for a year for a 6% dividend payment if the principle balance drops by 10, 20, 30% or more?

The list below should act only as a starting point to consider which ones may or may not be suitable for your objectives. The table has information which I consider to be irrelevant for trading decisions by may be important for an investment. Most notably, the last two columns: debt/equity and price/book ratios may worth further investigation when considering a longer term hold. Beta may be another consideration, anything over 1.0 is more volatile than the S&P 500, do you want to put your mother into stocks with more volatility than the overall market?