Markets have been quite choppy this morning and when it appeared they were settling down a little, macro news brought in more volatility. The markets are not out of the woods my any means, but holding above some techincal levels is slightly encouraging.

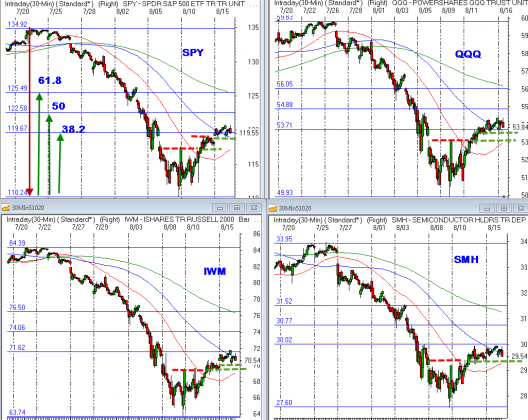

The 5 day moving averages (red) are advancing and the markets are holding at or above the declining 10 day MA (blue). This mixed message should be interpreted as reason to continue to keep our guard up.

Also very important technically (maybe even more so psychologically) the markets are trying to hold above the August 5 closing prices. August 5, of course, was Friday before we received word of US debt downgrade from S&P.

Fibonacci levels are also drawn on the charts and the 38.2% retracements seem to be taking on significance, how far you want to read into those levels is up to you.

The most important thing I will be watching is to see if the drawn in support levels hold, if they do not then things could get messy.