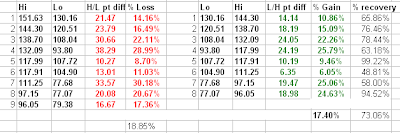

During the 2000-2003 bear market, the SPY made 9 significant drives lower and 8 recovery rallies. The average decline was 18.85% and the average recovery rally was 17.40% which means the market recovered an average of 73.06% of the prior loss. The speed and magnitude of the rallies in a bear market are quite seductive, but being early is just not worth the losses.

These numbers are just averages, there are always outliers and the current decline is unprecedented at least in my 16 year trading experience. If you are attempting to latch onto a counter trend rally remember that it is a high risk strategy, you must wait for price to confirm a possible turn before getting involved and then manage risk. As we saw today, there were many reasons to think the market would reverse higher, but those reasons were quickly dismissed by the market as prices faded in the last hour. Do not stubbornly hold when the market tells you to sell as it did today, there is always tomorrow to try again if you still have your capital intact.

Notice the DIRECTION of the 200 day (40 week) MA, it did not turn higher until April/May 2003. As long as the 200 DMA is declining all rallies should be expected to fail.

See the 1929-1933 Dow Chart