I have been invovled in Bitcoin and other cryptocurrencies since 2013 During that time, I have done well with Bitcoin, Ethereum and Litecoin. I have always been hesitant to mention trading them because the risks have been so high. Well, as you know, the rewards have been more than enough to justify those initial risks..

I will be adding analysis of Bitcoin, Ethereum and Litecoin (and an occasional mention of some alternative coins) for Alphatrends subscribers in 2018, this decision is based largely on the increased liquidity for trading cryptocurrencies.

The focus of Alphatrends will remain low risk, high probability swing trades of US Equities, it will not morph into a crypto crack site.

I see a lot of people doing “analysis” of the cryptos but one thing seems to be missing from most of what I read.. Risk Management! I often say “Risk Management is Job #1!” and I mean those words. My goal is to bring unbiased analysis of a risky (asset?) which does not assume that prices will continue to go up forever.

Here is the real question. Are cryptos appropriate for YOU? Only you know the answer to that question, below are some considerations.

For a small portion of your trading assets, the potential for trading opportunities seems too large to ignore. My personal strategy is to hold onto some of each of: BTC, ETH, LTC in case they do hit some of the absurd levels people mention, but I have already taken all of my original capital out so I am dealing from a position of strength.

As for trades, I will not give specific recommendations. Instead the reader be provided a well thought out and explained assessment using technical analysis on multiple timeframes as to why a trade may make sense. The analysis will include potential areas to enter, stop levels, where to think about taking some profits and when to stand aside from a trading perspective. I hope that the trades will last weeks to months but it will all depend upon market action how long to hold.

My longer term holdings in cryptos will have zero influence on trade decisions, each trade will be taken on its own merits and based only on technical analysis. This analysis will not be daily, it will be based on opportunities as the market presents them. I will not be up all night analyzing cryptos and answering questions about them, I will stick to normal (for me) hours when I am online.

As with any trade, “make it your own” don’t listen to anyone blindly to make your decisions. Find good information and if it makes sense to you then you have to decide what your timeframe is and make your trades accordingly.

The analysis of these cryptos will be provided to Alphatrends Gold and Silver level members for no additional fee, it is an added bonus! If you are interested in subscribing to Alphatrends, there is a current sale on annual subscriptions. Please send an email to support@alphatrends.net to inquire about it.

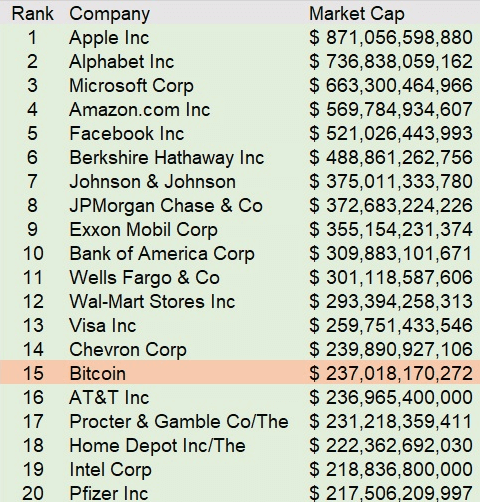

Like it or not, cryptocurrencies are becoming bigger each day, look at the market cap of Bitcoin versus the largest stocks in the S&P 500, it would be the 15th largest company if it was in the S&P 500!

Bitcoin futures are trading on the CBOE and at the CME

Even before we get a Bitcoin ETF, Direxion is planning leveraged long and short ETFs.

Related Reading, My article from January 2014 edition of Trader Planet Magazine

Bitcoin – A Fertile Environment For Disciplined Traders by alphatrends on Scribd