Will the bull market “end badly”?

That question has been asked countless times over the last nine years and even more often since the “Trump rally” began. My answer is two-part. First, no, I don’t believe it will end badly. And, second: It doesn’t have to end badly for you if you are proactive about risk management.

Regardless of whether you are a long-term investor, an intermediate-term trader or you choose to day trade, our job is the same: to ride our winners and cut our losers.

Think about how little control you have in the market and you realize quickly that it is a very short list, composed of what markets or products to trade, when to trade them, and how much you decide to buy or sell.

Compare this to the innumerable risks of holding stocks. There is no potential for reward unless you put your capital at risk. Calculation of our precise true risk is impossible to know with so many variables, including some unknowns which come in the form of surprises.

Traders go broke trying to pick tops and bottoms

The risk of losing our hard-earned capital can cause anxiety, which causes us to sell early, or worse, to throw caution to the wind and try to pick a top by selling short. Trying to pick a top or bottom is nearly impossible and has ended more Wall Street careers than any other approach.

So, back to the question of if the rally will end badly. The market will give us clear signs when the trend slows or shows signs of reversing. Until we have actual price evidence of a reversal, any attempt to pick a top is an exercise in futility.

Successful traders embrace the prevailing trends and try to focus on harvesting profits from those trends rather than trying to predict the end to a move.

While we may not be able to identify when a cycle of strength or weakness will end, that does not mean we cannot continue to profit. Yes, the risks of a deeper pullback become stronger the more extended a market move becomes, but the path of least resistance is clearly higher.

This market remains in a healthy uptrend, and the easiest way to make money in this market right now is trading from the long side. As a matter of fact, a sizable portion of the gains from the election low have come at the expense of those who have incorrectly sold short.

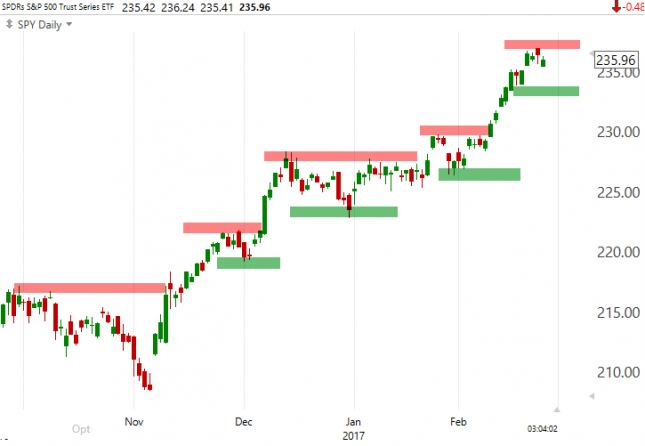

Beginning in November, price action in the S&P 500 ( ^GSPC, SPY) has shown a smooth and steady trend of higher highs and higher lows. If you are concerned about a reversal, focus on what you can control. Maybe a stop should be placed under one of the higher lows? What is your risk tolerance? What is your time frame?

Use stop losses to manage risk

For consistent results in the markets, you need a plan which recognizes risks, and then you need to implement the discipline to move aside as the market tells us to. One of the simplest ways to manage risk is a stop-loss on your positions. There is not one perfect level to place stops, but start with the definition of a trend: higher highs and higher lows.

Whatever your time frame is, consider a stop below “the most recent and relevant higher low.” A stop assures you will never sell the top of the move, but, more importantly, it will get you out of your position and into cash before it has a chance to “end badly.”